Fixed Income – Page 21

-

Asset Class Reports

Asset Class ReportsUS banks lead a boom in debt issuance

Capital requirements and locking in cheap funding have prompted banks to issue more bonds, but Europe lags behind

-

Asset Class Reports

Asset Class ReportsThe green bond imperative

A deepening pool of green bond issuance is allowing investors to direct capital towards objectives like energy transition

-

Features

FeaturesFixed income, rates, currencies: Economies at a sensitive juncture

Another new year and we are still in a COVID pandemic, as we were a year ago, although this time with economic grow-th looking pretty robust across the world. But, despite the best efforts of healthcare workers, scientists and politicians, the virus continues to exert an unnervingly strong influence on all our lives.

-

Asset Class Reports

Asset Class ReportsPortfolio Strategy – Fixed income report

As the earnings season gets under way in early January, we look at 2021’s bumper level of bank debt issuance, in particular from Bank of America, JP Morgan and Citigroup, which have all recorded big increases in deposits. Banks look set to benefit from rising rates this year, but also from their historically large capital buffers, diverse funding levels and central bank liquidity backstops and offer attractive valuations.

-

Country Report

Country ReportFunds collaborate on green credit

Swedish funds team up with fund managers by providing seed money for two new sustainable bond products

-

Features

FeaturesFixed income, rates, currencies: Policy normalisation kicks in

Although several emerging market (EM) central banks have been hiking rates for a few months already this year, particularly in Latin America, it was only in the third quarter of 2021 that the global share of central banks raising official rates moved above 50%. This is the first time in three years that this has been the case, as several developed market central banks joined emerging market counterparts to tighten rates.

-

Special Report

Special ReportNextGenEU: Towards a new euro yield curve?

Bonds designed to support member states hit hardest by the pandemic look set to become a new safe asset

-

Country Report

Country ReportInflation: Schemes keep wary eye on inflation

Few players anticipate rampant inflation rises, but pension funds are atuned to the actions of central banks around the world

-

News

NewsMandate roundup: FRR awards corporate bond mandates

Plus: Border to Coast launches £3.7bn multi-asset credit fund

-

News

UK roundup: MFS launches credit strategy for DB schemes, insurers

Plus: Overseas banking group closes buy-in deal for UK scheme

-

News

NewsSwiss Pensionskasse to align equity, bond portfolios with ESG indices

PKBS is considering impact investments through green or social bonds

-

News

OPF chief disappointed at government failure over buffer capital rules

Oslo municipal pension fund reports 7.7% return for January to September

-

Opinion Pieces

Green bonds – a ‘no-brainer’ paragon

Institutional investors are constantly searching for the elusive ‘no-brainer’ investment: the one that offers clear additional benefits without additional risk

-

Features

FeaturesFixed income, rates, currencies: Simmering tensions bubble up

After a reasonably peaceful summer – relative to the many previous volatile ones for capital markets, that is – simmering tensions are bubbling over, affecting many financial asset classes.

-

Country Report

Country ReportInvestment strategy: Shifting from fixed income

Swiss pension funds are rebalancing their portfolios but allocating to certain asset classes could prove challenging

-

News

Swiss scheme to exclude coal from bond portfolio

It will also assess, and if necessary adjust, the indices with regards to ESG and the climate strategy in its equity portfolio

-

Asset Class Reports

Asset Class ReportsAsset Allocation: Mixed prospects emerging

COVID and political risks may have affected EMs in different ways but there are still many opportunities in such a diverse asset class

-

Features

FeaturesFixed income, rates, currencies: Not quite back to normal

As the world struggles to get back to pre-pandemic conditions, with schools and offices open, economic forecasting seems even less predictable than ever. Take August’s US payrolls report, which again confounded most forecasters. Analysts scrambled to explain why the headline job gains were so weak, particularly after the huge (forecast-beating) gains the previous month.

-

Asset Class Reports

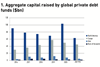

Asset Class ReportsThe next frontier for private credit

Global managers are making a strong case for investment in private credit issued by emerging market companies

-

Asset Class Reports

Asset Class ReportsEmerging market debt report

Our opening article in this report looks at emerging market private credit. In EMs there is a $100bn corporate funding gap with 90% of lending through banks. But we find EMD managers broadly cautious overall, particularly on China, with interviews conducted before the Evergrande story broke. Lastly, we look at Latin America, where investors encounter populism and social unrest but sustainability bond issuance is booming.