Fixed Income – Page 25

-

Opinion Pieces

Opinion PiecesViewpoint: Long-term lenders ideally placed to drive ESG conversations

With the world facing considerable and pressing environmental and social problems, the investment world has a critical role to play in addressing issues such as climate change, inequality and discrimination

-

News

NewsAsset management roundup: SLA China venture gets pensions licence

Plus: Debut Paris-aligned fixed income ETF; Invesco’s RI framework; Franklin Templeton starts investment institute

-

News

NewsFrjálsi’s foreign equities shine with króna-magnified returns

Sharp fall in central bank’s key rate led to good return on domestic bonds

-

News

NewsMandate roundup: Swiss scheme tenders green bonds

Plus: Scottish Enterprise awards admin, actuary and investment consulting mandates

-

News

NewsMandate roundup: Swiss scheme seeks bond managers for up to CHF3bn

Plus: Leicestershire Council scheme seeks actuary

-

News

NewsSwitch to video meetings puts Norway’s SWF off new managers

NBIM suggests low bond volatility undermines some of its rationale for including FI

-

Features

FeaturesIPE Quest Expectations Indicator - January 2021

US COVID-19 figures were rising rapidly at the time of writing. Western European figures were divided. Many showed a climbdown from the second wave but Germany, the UK and the Netherlands were faced with growing figures. Japan’s statistics were up, forming a third wave. In a few weeks, we will know how the deployed vaccines work in practice.

-

Features

FeaturesFixed Income, Rates, Currencies: A very different recovery

Amongst the remarkable happenings in 2020, from startling news of a pandemic to viable vaccine and beyond, has been the speed and scale of interventions from central banks and governments.

-

News

NBIM innovates to stay ahead of falling securities lending margins

Norwegian SWF executed its first peer-to-peer loan deal in 2020, report says

-

News

NewsItaly roundup: Priamo tenders fixed income, mid-cap equity mandates

Plus: Enpav to allocate €30m to real estate; Enasarco expects lower contributions; ENPAM approves 2021 budget

-

News

NewsVER brings in JP Morgan as new global custodian, replacing Danske

Finland’s State Pension Fund says bank is right partner in “exceptional times”

-

News

Japan’s GPIF seeks input on low yield environment entrenchment

¥167.5trn (€1.4trn) pension investor also looking for ideas about estimating returns for bonds in post-pandemic era

-

News

NewsCEPB’s Matthews calls for ‘Climate Action 100+ for sovereigns’

Reveals Transition Pathway Initiative will next year produce sovereign bond assessments

-

Features

FeaturesFixed Income, Rates, Currencies: Vaccine boosts bullish markets

The swings in outcome predictions as the vote counting began in the US election were large. From the realisation that there was no blue wave of Democrat success, to a possible re-election for Donald Trump, to a Joe Biden win but with a Republican Senate, it was tricky to comprehend the investment implications.

-

News

Survey: Portfolio diversification can help push return targets

The pandemic and low interest rate environments will likely exacerbate pressure on returns

-

Opinion Pieces

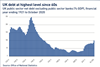

Opinion PiecesViewpoint: The tipping point for UK pension schemes

Schemes need to consider how to get to a secure level of funding, but also, the assets they will need to hold when they reach peak cashflows in order to remain fully funded

-

News

Italy roundup: Inarcassa rejigs government bonds allocation

Plus: Pension fund returns improve, Fopen seeks fund depositary, Fondoposte elects president, VP, Previp chooses Anima Sgr over BNP Paribas

-

News

German investors urged to build up global portfolio to boost returns

Spezialfonds invest 15.7% in equities of German companies, compared to 2.4% in the MSCI AC World Index

-

News

Icelandic pension funds see foreign allocations grow in 2020

Frjálsi targets 30% foreign asset allocation in 2021

-

News

Border to Coast launches £1.5bn internally managed bond fund

Durham, North Yorkshire and South Yorkshire are the initial investors in the sterling-denominated fund