Fixed Income – Page 33

-

Features

FeaturesFixed income, rates, currencies: Hope but also fears for 2019

US domestic investors hold healthy stock market profits after a decade-long bull run Geopolitics on many fronts point to tumultuous times ahead

-

News

ABN Amro seeks manager for European ESG credit via IPE Quest

Dutch bank’s pension fund to offer €500m-€600m mandate

-

News

GAM forecasts CHF925m loss after rocky 2018

Swiss asset manager proposes cancelling dividend in wake of outflows

-

News

Nordic insurer seeks developed market bond manager via IPE Quest

Unit-linked insurer has $50m investment grade active mandate to award

-

Features

Fixed income, rates, currencies: Challenges still lie ahead

While the US mid-term elections saw the Democrats regain the House of Representatives, trade policy remains in the hands of the White House. Trade tensions, between the US and China in particular, will remain to the fore. President Trump’s aggressive trade policy is already having a global impact with declining purchasing manager indices indicating corporate hesitation in future plans.

-

Features

ESG: Scheme to develop green mortgages

Lenders see an apparent correlation between energy efficiency and lower defaults

-

Features

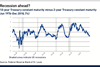

What next for US Treasuries?

A consensus on the direction of 10-year US Treasury rates is not obvious, because the answer reverts to a further question: whose consensus? Strategists, economists and other informed professionals have a particular view. The market itself, however, expresses a more diffuse and different opinion.

-

News

NewsUK public pension pool preps £2bn corporate bond fund

Fixed income tender marks latest step in process of pooling nine partner funds’ assets

-

News

MiFID II has shrunk fixed income research market, research indicates

ICMA survey finds asset managers using fewer providers as availability of research declines – but quality ‘has not changed’

-

News

NewsChart of the Week: European private debt assets hit record $200bn

Number of private debt funds targeting Europe shrinks compared to 2017

-

News

UK charity denied permission to lower indexation in landmark case

But a bigger case for UK pension schemes is on the horizon

-

News

NewsAP2 predicts boom in public sector green bond issuance

Dutch regulator also notes growth of green bond asset class

-

News

UK asset management body calls for bond market data boosts

Proposals formulated in light of best execution requirement under MiFID II

-

News

NewsGAM boss Friedman exits after outflows spike

Investors have pulled billions from the Swiss asset manager since it suspended a senior bond fund manager in July

-

News

NewsShell’s in-house manager eyes property loans, alternative credit

Shell Asset Management Company spots new opportunities as QE continue to suppress listed bond yields

-

News

Netherlands to be first AAA-rated issuer of green bonds

Annual amount expected to be between €3.5bn and €5bn

-

Special Report

Convertible Bonds: Just the ticket

US convertible bonds have come into their own in the low-interest-rate environment

-

Special Report

Fixed income: Will it be E, S or G?

The three components of ESG investing in fixed income – environmental, social and governance – cannot be maximised simultaneously. Investors must decide which to emphasise

-

News

Netherlands roundup: Shipping scheme scraps individual DC plan

Plus: Dutch savers have missed out on 15% inflation-linked uplifts on average

-

News

Swiss fund to reassess private assets in strategy overhaul

Portfolio restructuring brings higher credit exposure and focus on risk categories