Fixed Income – Page 5

-

News

NewsOsmosis Investment Management to launch Dutch fixed income franchise

The new firm will be led by former Robeco fixed income CIO Victor Verberk and is planning to launch sustainable investment-grade bond and high-yield funds within a year

-

News

NewsTPT Investment Management launches £720m investment grade bond fund

This is the fifth of TPTIM’s seven planned fund launches

-

News

NewsFondaereo selects asset managers as it sets up new sub-funds

The scheme is selecting managers to invest assets worth €265m

-

News

NewsInflows to Spezialfonds stagnates as investors eye direct fixed income allocations

Spezialfonds also failed to record higher inflows year-on-year in 2024 from retirement benefit schemes

-

News

NewsAP7 posts 27.3% return after ‘fantastically good year’

Swedish premium pension default fund reports leverage and weaker krona magnified strong stockmarket last year

-

Research

ResearchIPE institutional market survey: Investment grade credit managers 2025

IPE’s 2025 Investment Grade Credit Survey covers 55 managers with a total of €3.6trn in assets managed in investment-grade credit strategies globaly.

-

Asset Class Reports

Asset Class ReportsEurope investment outlook: Search for opportunities amid the gloom

We asked fixed-income managers for their views on Europe’s outlook as Germany and France grapple with structural challenges and political uncertainty.

-

Asset Class Reports

Asset Class ReportsTrade and economy weigh on European credit

Despite trade worries and a challenging economic outlook, appetite for European credit remains robust, bolstered by refinancing activity and a supportive ECB stance

-

News

NewsSwiss schemes nudged to cut fixed income amid low interest rates

From 2014 to 2022, Swiss pension schemes’ allocation to fixed income investments fell from 39.2% to 31.7%

-

News

NewsPensionDanmark to ramp up equities after 17% stocks gain in 2024

Danish pension fund to increase the equity proportion particularly for younger scheme members, and postpone risk reduction starting point by five years to age 50

-

Features

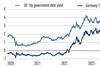

FeaturesFixed income, rates, currencies: Trump 2.0 sends global markets out of sync

Trump’s re-election prompted a rally in US assets, but elsewhere in global markets investors did not react positively

-

Features

FeaturesIPE Quest Expectations Indicator - January 2025: hard to pick short-term winners

IPE’s latest manager expectations survey finds high net sentiment across most main asset classes as allocators weigh the Trump trade

-

News

NewsDutch pension fund appetite for mortgages almost saturated

Most schemes have now reached their target allocation to the asset class, which is also experiencing renewed competition from listed bonds

-

News

NewsAssociations back credit ratings in EU post-trade transparency framework

BVI, AFME, bwf, EFAMA and ICMA are asking for a distinction between investment-grade and high-yield corporate bonds

-

News

NewsNorway’s SWF seeks green light to sell slowly-growing Russian assets

NBIM also makes first Israeli company blacklisting since ethical council stepped up its stance regarding Palestinian territory occupation

-

Features

FeaturesIPE Quest Expectations Indicator - December 2024

Bond expectations falling, equity mostly flat

-

Features

FeaturesFixed income, rates, currencies: All eyes on Trump’s return

With the Republican Party now in control of both Senate and House, the leeway that President-elect Donald Trump will have to enact his pre-election policies could be considerable.

-

News

NewsItaly’s CDC scheme to invest €1.1bn across equities, bonds, alternatives

The scheme will invest 72.4% of the €1.1bn planned for next year in bonds, 4.5% in equities, and 23.1% in illiquid alternatives, including real estate

-

News

NewsATP’s returns leap in Q3 despite private equity write-downs

Danish pensions giant posts 9.7% gain on investment portfolio in January-September despite massive private equity wipeout

-

Country Report

Country ReportSpanish country report 2024: Pension funds eye a new rate environment

Buoyed by strong returns, pension funds have been lengthening the duration in their fixed-income portfolios