Fixed Income – Page 52

-

Features

Asset Allocation: The big picture

This year looks like it could be remembered as the Bund sell-off year, or perhaps even the Bund Blowback, with one of the intraday price falls larger than any recorded (by Bloomberg) in the past quarter century

-

Analysis

AnalysisAnalysis: How NEST wants to shape the future of retirement

Taha Lokhandwala studies the details of NEST’s planned at-retirement investment and decumulation strategy

-

News

Asset manager involvement in lending market raises 'new risks' – BIS

Mandates can give rise to ‘leverage-like behaviour’ that amplifies financial stress, Bank for International Settlements warns

-

News

ECB to ‘act as backstop’ to protect markets from Greek default contagion

Asset managers call for calm in euro-zone despite expected Greek default

-

News

Belgian pension fund OGEO increases assets to more than €1bn

Municipal employees scheme brings assets in-house but sees returns drop for second consecutive year

-

News

Friends Life mandate with AXA IM handed over to Aviva Investors

Friends Life was one of UK’s largest insurers before its takeover by rival Aviva

-

News

Concern over pension-fund shadow banks 'exaggerated', PIMCO says

Institutional investors have little in common with unregulated banks, asset manager says

-

News

NewsIcelandic pension funds agree to finance $300m silicon metal plant

Local pension funds to offer part of financing required for factory in country’s north

-

News

Transport for London pension fund drops LGIM for BlackRock

Pension scheme for transport workers hands over majority of assets to BlackRock in LDI, passive equity mandates

-

News

Switzerland's AHV drops soft commodities due to 'political sensitivity'

First-pillar fund’s future commodity investments to include energy, precious metals only

-

News

CPPIB acquires GE private placement arm in $12bn deal

Canadian fund agrees to purchase Antares Capital to create platform for investment in US middle-market lending

-

News

PPF 'disappointed' with UK pension funds' lack of interest in LDI

Chief executive says number of UK schemes using LDI contributed to lack of funding improvement since 2005

-

News

APK calls for ‘scenario testing' over traditional valuation methods

Christian Böhm says QE making traditional valuation difficult, calls for assets to be evaluated for ‘sensitivity’ to scenarios

-

News

PFZW demands ‘change in mentality’ over carbon emissions approach

Pension fund says its 2020 target to halve carbon emmisions should help create a more sustainable world

-

Special Report

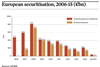

Special ReportRegulatory environment still weighted against Europe's ABS market

The European market for asset-backed securities has ample potential but suffers as a result of an unfavourable regulatory regime

-

News

Sampension reports record Q1 return driven by low interest rates

Pension fund says ECB purchase programme boosting fixed income portfolio helped produce strong quarterly position

-

News

Publica returns boosted by equities, corporate bonds

Swiss public pension fund says 2014 returns would have been 8.9% if not for approach to hedging

-

News

UWV scheme ups risk profile in favour of liquid assets

Change in asset allocation towards equity and mortgage bonds follows survey into participants’ risk appetite

-

News

Royal Mail maintains pension surplus on back of strong Gilt returns

Increased surplus comes despite comparable increase in liabilities of £1.3bn across both funds

-

News

European supervisors call for more coherent securitisation framework

Joint report by supervisors calls for policymakers to align disclosure, due diligence framework for all institutional investors