Fonds de reserve pour les retraites (FRR), France’s €32.7bn pension reserve fund, has said it is committing to investing, by 2022, €500m in French late stage/growth funds and in global tech funds managed in France.

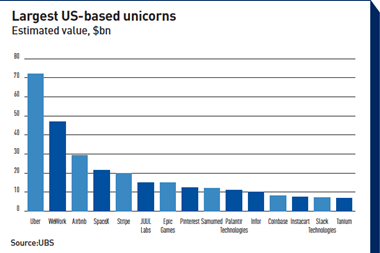

FRR’s commitment was made in the context of a government drive to promote French start-ups and encourage so-called unicorns (privately held firms valued at more than $1bn [€900m]) to list in Paris.

Last month, in connection with “France Digital Day”, Emmanuel Macron announced that French institutional investors had pledged to invest up to €5bn, split across two categories: €2bn for investments in late stage or growth companies – unlisted equities – and €3bn for global tech funds that invest in listed companies and are managed by France-based asset managers.

FRR is one of the investors to have publicly disclosed its involvement.

A spokeswoman for ERAFP, France’s €29.6bn additional pension fund for civil servants, said it was also part of the investor group but could not reveal how much it would invest.

Investments would be progressively directed towards tech in the context of the relaxation of its investment restrictions. ERAFP was recently granted permission to invest more in unlisted assets and mutual funds.

FRR noted that the €500m it is committing is on top of a €2bn allocation to French illiquid assets that was decided several years ago and was now already largely invested.

Yves Chevalier, executive director at FRR, told IPE that the €500m would be split equally across the venture capital late stage funds and the funds for investment in global listed tech companies.

“These aren’t investments that we’ll be making immediately,” he said. “We’ll give ourselves the time to define a strategy to implement it in 2020 and 2021.”

25 unicorns in France by 2025

Macron said the government wanted to see 25 French unicorns created by 2025.

According to a report prepared for France’s economy ministry earlier this year, France had the attributes to be a leader of “the fourth industrial revolution” – defined by the World Economic Forum as a fusion of physical, biological and digital technologies – but a lack of late-stage funding was preventing French technology companies from growing. French venture capital funds were typically smaller than their main foreign rivals, it said.

Initial public offerings, meanwhile, were fairly rare in France and when they did take place, did not generally raise enough funds to transform the company in question.

The report, written mainly by Philippe Tibi, the former head of Swiss bank UBS, recommended that institutional investors be invited to support venture capital funds focussed on the late-stage segment and based in France. It also recommended encouraging the emergence of global listed tech equity funds and managed by teams primarily based in France.

More specifically, according to the report, France needed to attract about €10bn and recruit 50 asset managers in three years’ time. Of this total, some €8bn would have to come from institutional investors, it said.

Pour la réussite de notre écosystème numérique, j’ai fixé un objectif clair : pic.twitter.com/r6KCVy5Q83

— Emmanuel Macron (@EmmanuelMacron) September 17, 2019