Government Bonds – Page 10

-

News

NewsMandate roundup: AP1 tenders for new global custodian

Plus: Italy’s Fon.Te picks government bonds manager

-

Features

FeaturesFixed income, rates, currencies: Clouded by uncertainty

It was predictable that risk markets should have reacted positively to the news of an agreement in principle in the US-China trade negotiations. Although assuredly better than a seemingly relentless stream of bad will between the protagonists, the provisional agreement is in no way a solution to the conflict. Another round of trade talks could be necessary just to reach a tentative accord. Investors would be wise to temper enthusiasm to extrapolate the ‘good news’ too far.

-

Features

FeaturesEverything is still possible

Markets are on edge as a result of difficult economic and geopolitical forces. Risks are still skewed to the downside. Trade tensions have not abated, rather there is a possibility of further escalation in the future, which looks like reducing investment, and damaging already apprehensive outlooks.

-

Features

IPE Quest Expectations Indicator: September 2019

Market sentiment has split in two. For the euro-zone and the US, there was a correction that did not affect trends and equities are still favoured. In the UK and Japan, sentiment is moving towards favouring bonds

-

Features

Fixed income, rates, currencies: A bleak outcome

This year’s summer tensions in shallow markets have again been apparent. The fallout from the trade dispute between China and the US is having a global impact. Together with economic weakness almost everywhere, a global policy easing cycle could be imminent.

-

Features

FeaturesIPE Quest Expectations Indicator: July 2019

Markets are still driven by political risk and growth prospects. It looks like the two risks are working in the same direction this month.

-

Features

FeaturesIPE Quest Expectations Indicator: August 2019

It looks like political risk is taking a back seat to growth this month, continuing last month’s trend.

-

Features

FeaturesFixed income, rates, currencies: Nervousness abounds

The weak US non-farm payroll (NFP) data for May, far below forecasts, sent rates falling and stocks rising, on the supposition that it raised the likelihood of interest rate cuts from the Federal Reserve. On the other hand, while risk markets cheered the prospect of easier money, the hardline approach taken by the US towards China, and China’s uncompromising responses are raising investor nervousness.

-

Special Report

Special ReportInvestment services: Accessing China's bond market

Access to China’s fixed-income market is cheaper and easier than ever

-

Features

FeaturesFixed income, rates, currencies: Politics remains the bellwether

Financial markets continue to be influenced by news, and tweets, about the US-China trade negotiations. While stock markets have sold off during the second quarter of 2019, and credit spreads have widened, this financial tightening is so far less than what happened over the last few months of 2018.

-

Special Report

Indices and Benchmarks: The Chinese dam breaks

Global bond indices have started including the Chinese domestic bond markets in their benchmarks

-

Asset Class Reports

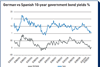

Asset Class ReportsGovernment Bonds - Euro-zone: Turning Japanese

The euro-zone appears to be in a low-growth liquidity trap redolent of Japan

-

Asset Class Reports

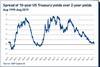

Asset Class ReportsUS Treasuries – still safe?

Rising US government debt levels are posing a conundrum for bond investors

-

Features

FeaturesFixed Income: Markets take nervous turn

Almost every asset class did well in the first quarter of 2019

-

Features

FeaturesFixed income, rates, currencies: Markets take nervous turn

The reaction and aftermath to the US Federal Reserve’s dovish pivot appears to be more focused on the monetary policy news itself and the ‘fuel’ of easy money.

-

Features

FeaturesIPE Quest Expectations Indicator: March 2019

When uncertainty hangs over the financial markets, indices tend to converge. That is true for net sentiment of equities

-

Asset Class Reports

Asset Class ReportsRatings: When corporates can trump sovereigns

Several factors can place corporate credit ratings higher than that of the domicile country

-

Features

FeaturesIPE Expectation Indicator: February 2019

The end of 2018 saw expectations shift meaningfully in certain markets, and then pause. It also saw trends accelerate, then pause. For most of us, the pauses were welcome, because the shifts were related to broad market plans

-

Features

FeaturesFixed income, rates, currencies: Clouds to darken further

Markets have pulled back from US rate hike forecasts; Euro credit looks set to be most vulnerable to quantative tightening; The European elections in May look set to see a surge in support for populist parties

-

News

NewsFTSE Russell finalises fixed income country classification framework

Index provider sets out guidelines for government bond indices, launches Chinese green bond index