Government Bonds – Page 8

-

Features

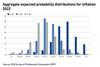

FeaturesFixed income, rates & currency: inflation battle in full swing

As we reach the midpoint of the year, there is little sign that the second half of 2022 will be any less turbulent than the first. The conflict in Ukraine slogs on – a destructive war of attrition, pain and fear. The repercussions are huge, global and unpredictable, be they surging energy prices or impending, but acute, shortages of basic foodstuffs, or of semi-conductors, so vital to 21st century life.

-

Asset Class Reports

Asset Class ReportsCredit: Inflation and the bond markets

Risks look likely to be building in credit as central banks wreak collateral damage on economies in their bid to tame inflation

-

Features

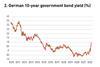

FeaturesFixed income, rates & currency: disappearing safe havens

Risk markets have been having a torrid time of late. ‘Risk-free’ government bond markets are not providing any safe havens in these storms, with curves steepening and considerable volatility in longer rates.

-

Special Report

Special ReportOutlook: Good riddance to negative interest rates

The net effect of setting interest rates below zero is negative, and central banks may be wary of such policies in the future

-

Opinion Pieces

Opinion PiecesViewpoint: Swap spreads at stress levels

Asset swap (ASW) spreads are currently trading at historically high levels as volatility in rates markets has remained high. We believe there is an opportunity for continental European pension funds to enter into Euribor receiver swaps and sell Bunds in their matching portfolio. Indeed, we expect that the peak in ...

-

News

PMT, PME ditch ‘authoritarian countries’ from EM index

The two Dutch pension funds have sold Egypt and Vietnam government bonds as a result of the policy change

-

News

NewsMandate roundup: Swiss pension fund seeks manager for index strategies

Plus: Italian scheme signs up to BNP Paribas’ ESG platform; Mercer wins OCIO contract

-

News

Danish pensions lobby proposes sector pitches in to build national defence

IPD proposes ‘completely new PPP collaboration’, in the light of the war in Ukraine

-

Asset Class Reports

Asset Class ReportsCredit: Anthropocene fixed income

Former credit portfolio manager Ulf Erlandsson is on a mission to shake up the bond markets’ climate-change credentials

-

News

NewsNorway adds Russia, Belarus to SWF’s bond blacklist; says fund is not policy instrument

North Korea and Syria to remain part of “government bond exemption”, says finance ministry

-

Features

FeaturesFixed income, rates, currencies: Inflation spotlight on central banks

Not often far from the action, central banks have been centre stage in 2022 as one after another in the developed markets reveal their hawkish intents. The speed and synchronicity with which they have shifted has been pretty remarkable, with only the Bank of Japan not yet joining other main central banks.

-

News

NewsRisk analytics company claims new standard for sovereign ESG analysis

Verisk Maplecroft says its ratings show environmental and social factors are highly material for bond pricing

-

Asset Class Reports

Asset Class ReportsUS banks lead a boom in debt issuance

Capital requirements and locking in cheap funding have prompted banks to issue more bonds, but Europe lags behind

-

Special Report

Special ReportNextGenEU: Towards a new euro yield curve?

Bonds designed to support member states hit hardest by the pandemic look set to become a new safe asset

-

News

IPD: Danish central bank must ensure green bonds OK for pension funds

Lobby group calls on central bank to liaise with FSA over planned inaugural green bond issuance

-

Features

FeaturesIPE Quest Expectations Indicator - August 2021

The next wave of COVID-19 has come to pass earlier than expected, largely due to new variants. The UK is hard hit, being sensitive to variants Alpha, Beta and Delta. The EU is next in line, with the Netherlands, Spain and Denmark in the forefront and Delta playing a leading role, but other member states are right behind. There is no sign of the next wave in the US yet, but it is sensitive to the variants Gamma and possibly Alpha, which plays a role in Canada.

-

News

NewsDutch insurer seeks managers for small-cap equity

Plus: Discovery search for global EM fixed income

-

Features

FeaturesBriefing: China bonding with the world

It is tantalising to imagine the concept – that the standard global fixed-income portfolio, which has stood the test of time for so long, may be about to unravel. The standard bearers – US Treasuries, the UK Gilts, German Bunds and Japanese government bonds (JGBs) – may soon have to share the stage with a brash newcomer: Chinese government bonds (CGBs).

-

News

NewsPMT reduces government bond allocation, ups real estate and infra

The €97bn pension fund’s new strategic asset allocation is supposed to have a lower risk profile

-

News

PFA’s CIO favours equities as perceptions of risk-free shift

Danish pension fund’s portfolio mapping exercise produced allocation insights