Green Bonds – Page 5

-

Features

FeaturesIPE Quest Expectations Indicator March 2023

The next Ukrainian offensive will be in April at the earliest, as modern tanks will have arrived by then. US Republican pushback of ESG and climate-related investments are a new bone of contention in relations with the EU, already strained by the Trump presidency, and a bad sign for US-EU co-operation on China policy, an issue Japan seems to be ducking successfully. Aided by a soft winter, EU energy concerns have become quite manageable.

-

Special Report

Special ReportNatural capital: Investors press for impact

The focus is starting to shift from pure risk reporting to ensure that investments have a positive effect on declining biodiversity

-

Asset Class Reports

Asset Class ReportsPrivate debt: Sustainable lending set for comeback

Issuance of sustainability-linked paper took a hit in 2022, but managers are now introducing ESG KPIs to incentivise borrowers

-

Features

FeaturesFrom soft landing to no landing

Once again, the US jobs market has shown its capacity to surprise forecasters, if not astonish them. January’s non-farm payroll numbers came in way above consensus forecasts, swiftly reversing markets’ dovish take on that week’s central bank actions, with bond markets handing back much of their earlier gains.

-

News

NewsNZAOA, BTPS, Church of England back climate performance tool

‘There is no rating or ranking or investment advice, just free, comparable data points for investors to use as they wish,’ says Barron

-

Asset Class Reports

Asset Class ReportsAsset class report – Fixed income

Last year was the worst in recent decades for both government bonds and credit, with portfolio returns worse than most professionals have experienced in their careers. But is the tide finally shifting as inflation starts to moderate and terminal policy rates are in sight? In any case, geopolitical risks and inflation are not set to go away, and recession will inevitably take a toll on corporate issuers.

-

Asset Class Reports

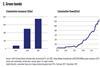

Asset Class ReportsFixed income: Transition plans and green bonds

Should companies publish climate plans before they can issue green bonds?

-

News

Dutch pension funds keep investing in green bonds despite market rout

In contrast, pension schemes’ exposure to regular bonds has decreased by some €200bn this year

-

News

Austrian Treasury plans commercial paper issuance to fund green projects

Austria raises €1bn in first issuance of green treasury bill

-

News

ESG roundup: Industriens Pension joins Net-Zero Asset Owner Alliance

Plus: Finnfund issues €75m sustainability bond; AXA IM discloses own global carbon footprint

-

News

Switzerland raises CHF766m with first green bonds issuance

The Swiss green bond framework is aligned with the Green Bond Principles set by ICMA

-

News

NewsSustainable advisers call for green bonds to retain ‘taxonomy-aligned’ status

Platform on Sustainable Finance asked the Commission to ‘grandfather’ green debt under the taxonomy

-

News

NewsSustainable finance roundup: Redington’s research on climate-related commitment

Plus: Smart Pension and AXA IM in biodiversity partnership; Finnfund creates framework for sustainability bond issuance; German sustainable finance committee sets up priorities

-

Special Report

Special ReportTo Paris and beyond: capturing energy transition and climate investment opportunities with ETFs

The climate emergency is arguably the greatest challenge of our lifetimes. We must use every tool at our disposal – including financial – to stand any chance of success. Thankfully, investors are ever more aware that incorporating climate in their portfolios can help them manage asset-specific risk, access opportunities from the shift to clean energy and achieve something meaningful with their money. And they are ever more aware they can do it in flexible, cost-effective ways.

-

News

Inarcassa shifts to corporate bonds with higher ESG rating

This summer the scheme recorded returns of -7% amid increased volatility in financial markets

-

News

Finance For Biodiversity launches Sustainability-linked Sovereign Debt Hub

While numerous governments have green bond programmes, Chile is the only country to have issued a sustainability-linked bond

-

News

NewsGeneva pension fund invests CHF100m in green bonds

CPEG also bought its first social bond issued by the canton of Geneva for CHF50m to finance projects with a positive social impact

-

Features

FeaturesFixed income, rates & currency: inflation battle in full swing

As we reach the midpoint of the year, there is little sign that the second half of 2022 will be any less turbulent than the first. The conflict in Ukraine slogs on – a destructive war of attrition, pain and fear. The repercussions are huge, global and unpredictable, be they surging energy prices or impending, but acute, shortages of basic foodstuffs, or of semi-conductors, so vital to 21st century life.

-

Asset Class Reports

Asset Class ReportsCredit: Anthropocene fixed income

Former credit portfolio manager Ulf Erlandsson is on a mission to shake up the bond markets’ climate-change credentials

-

Asset Class Reports

Credit: EU raises the green bond stakes

The EU is considering making its Green Bond Standard mandatory