Hedge Funds – Page 2

-

News

To rebalance or not? Dutch pension funds face dilemma as illiquids exceed limits

Bpf Bouw will sell close to €3bn in hedge fund investments and is also reconsidering its private equity and real estate holdings

-

News

Poll shows 10 percentage-point rise in ESG use by alternatives investors over 3 years

Two thirds of European investors in private equity, infrastructure, now have climate policies compared to less that a quarter of their US peers, new survey shows

-

Country Report

Country ReportInvestment strategy: Asset allocation at a time of uncertainty

Senior investment figures give their views on asset allocation

-

Interviews

InterviewsOn the record: Emerging markets

Despite the current volatility and geopolitical tensions, European pension funds continue to actively seek returns from emerging market investments.

-

Interviews

InterviewsOn the record: Hedging all bets

We asked three European pension funds about their hedge fund portfolios, as the volatile market environment provides opportunities for absolute-return managers

-

Asset Class Reports

Asset Class ReportsPortfolio strategy – Hedge funds: macro bets on

Global macro funds should do better in the current market environment – but not all will thrive and investor due diligence will be key

-

Asset Class Reports

Asset Class ReportsPortfolio Strategy - Hedge Funds: Juggling the ESG imperative

ESG has the power to transform, but do hedge funds have the drive, data and determination to fit sustainability into their investment process?

-

News

European alternatives set fundraising record year

Europe now accounts for 24% of the global alternative assets industry

-

News

Cerulli calls on hedge funds to partner with European investors

‘Providing additional services will be challenging for smaller managers’

-

Opinion Pieces

Opinion PiecesLetter from US: The rise of the new alternatives

Pension funds and other institutional investors used to invest in hedge funds aspiring to outperform public stock and bond benchmarks. Now, after years of disappointing performances, they have changed their attitude. They still invest in hedge funds, but the new expectation is simply to get a few percentage points above the return on zero risk investments.

-

News

Dutch hedge fund exodus a risk, say consultants

PMT, PME, PFZW, Fysiotherapeuten, Provisum and the staff pension fund of pension asset manager APG have all said goodbye to the asset class

-

News

ABP exits hedge fund investments

The pension fund paid €331m in performance fees to hedge fund managers last year

-

News

Hedge funds lag behind peers on ESG investment factors - bfinance

Many hedge funds are still reluctant to make ESG integral to their investment processes

-

Features

FeaturesStrategically Speaking: Capstone Investment Advisors

Last spring’s exceptional market volatility proved the mettle of at least one set of strategies – volatility-focused hedge funds. The CBOE Eurekahedge Tail Risk Hedge Fund index returned a bumper 51.64% in the first three months of 2020 alone against a broad hedge fund market index return of -7.96%, and was up 34.8% for the year.

-

Features

FeaturesHedge funds: Coping with low interest rates

Historical analysis suggests portfolios of certain quant hedge fund strategies may offset some of the risk of rising interest rates

-

News

NewsEuropean stimulus package arriving by snail mail, laments Veritas CIO

Varma CIO says investment market not reacting to vaccine delay, variations

-

Asset Class Reports

Asset Class ReportsHedge fund performance: 2020, year of the human touch

Diversification is back in favour for hedge funds and those with a downside protection mandate delivered during the crisis

-

Asset Class Reports

Asset Class ReportsHedge funds and distressed debt: Competition for assets will be fierce

Hedge funds will have to compete with private equity and credit funds for distressed opportunities following the pandemic

-

Features

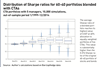

FeaturesHedge funds: ‘Real life’ portfolio evaluation

Outlining an equal volatility-adjusted approach to hedge fund management

-

News

Dutch building scheme sticks to ‘expensive’ PE, hedge funds

The fund reduced management fees for hedge funds by 27% during the past five years by negotiating service fees