Hedge Funds – Page 3

-

Special Report

Cash, currency, hedge funds, private equity 2020

Cash, currency, hedge funds, private equity on behalf of worldwide and external European institutional clients

-

News

Dutch Hewlett Packard scheme dumps hedge funds, scales back equities

These and other changes mark the completion of an asset mix overhaul by the €2bn pension fund

-

Special Report

Cash, currency, hedge funds, private equity 2019

Cash, currency, hedge funds, private equity on behalf of worldwide and external European institutional clients

-

News

Hedge funds warn regulators over ineffective ESG regulation

AIMA argues scope of regulation must include corporate disclosure

-

Asset Class Reports

Asset Class ReportsCryptocurrencies: A match made in heaven – or hell

Cryptocurrencies could offer handsome returns to hedge funds. Or they could be a disaster

-

Asset Class Reports

Hedge Funds - Technology: The next generation

Advances in artificial technology and computing power are opening paths to new hedge funds strategies

-

News

Dutch retailer scheme to ditch hedge funds

Pension fund cites high costs, poor sustainability and lack of transparency

-

Opinion Pieces

Hedge funds under scrutiny

Last year was good for hedge funds in terms of raising new money. But at the same time the industry suffered its biggest annual loss since 2011

-

News

Asset owners ‘should push for strategy, fee innovation’ at hedge funds

Hedge funds too focused on tangential issues, says Willis Towers Watson

-

Asset Class Reports

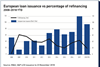

Asset Class ReportsLeveraged loans: Applying leverage

Leveraged loans have performed well recently but regulators are expressing concerns about risks

-

Asset Class Reports

Banking debt: The paradox of bank debt

The peculiarity of bank debt is that it can be issued by institutions with strong balance sheets

-

Asset Class Reports

High yield: Coping with a new environment

This year high-yield investors will have to weather not only the winding up of quantitative easing but additional political challenges

-

Special Report

ESG hedge funds: a contradiction in terms?

ESG hedge fund sounds like an oxymoron. The goals of absolute returns and the ideals of sustainable investing appear to be in opposition – self-contradictory, even

-

Asset Class Reports

Hedge Funds: Activist funds turn up the heat

Several hedge funds are among the most successful activist investors

-

Asset Class Reports

Time for new alpha ideas

New products are making hedge funds look like an expensive way to access alpha

-

Asset Class Reports

Managed Futures: In pursuit of ‘crisis alpha’

Professional stock-picking and portfolio construction are still valid strategies

-

Asset Class Reports

What future for long/short equity?

Managers are finding new ways to pursue long/short equity strategies

-

News

NewsTwo-thirds of hedge funds fall short of index returns after fees

Study finds investors typically paid 2.2% in direct hedge fund fees despite underperformance

-

News

NewsABP pays higher fees to hedge funds despite 2017 losses

Dutch civil service scheme posted a 7.6% return for the year across its investment portfolio

-

Asset Class Reports

Asset allocation: An expanding universe

Sub-investment-grade debt markets are becoming more sophisticated and fund managers have taken note