Hedge Funds – Page 6

-

News

EAPF prioritises private debt over hedge funds in alternatives push

Fund returns 15.1%, overhauls investment strategy as it lowers equity exposure

-

News

Hedge funds hope to salvage Greek gains despite turmoil

Many hedge funds have bet Greek politicians, EU technocrats will avoid Grexit

-

News

Hedge funds need to increase reporting transparency, Northern Trust warns

Development of industry-wide data standards to help disclosure, company argues

-

News

West Midlands ditches hedge funds to reach benchmark allocation

£10.1bn local government scheme to divest £200m from hedge fund partners

-

Features

Hedge funds: PFZW decision highlights divergent thinking

When Europe’s second-largest pension fund drops hedge funds and announces its new investment strategy will place greater emphasis on intelligibility, the industry takes note.

-

News

PFZW drops hedge funds from strategic investment portfolio

Second-largest pension fund in Netherlands cites complexity, cost and SRI concerns

-

Asset Class Reports

Investing In Hedge Funds: About turn for top-down

Macro, the darling of the hedge fund world through the drama of 2008-09, has struggled in the subsequent low-volatility, low-rates environment. Joseph Mariathasan asks whether recent outperformance signals a more conducive backdrop for this family of strategies

-

Asset Class Reports

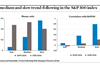

Asset Class ReportsInvesting in Hedge Funds: Is the trend your friend?

Alex Greyserman looks at how trend-following at different speeds has fared in equity markets during the post-crisis bull market and over the longer term, and finds compelling diversification benefits

-

Asset Class Reports

Investing in Hedge Funds: Uncut hedges

US pension giant CalPERS may have stopped investing in hedge funds, but despite heightened short-term scrutiny, Christopher O’Dea finds that most plans are retaining their allocations, and expecting them to deliver greater value through bespoke strategies

-

News

IPE Awards: How should activist hedge funds behave? (video)

Craig Stevenson, senior investment consultant at Towers Watson, discusses where allocations to activist hedge funds should sit in pension fund portolios

-

News

NewsNordic investors shun hedge funds in favour of risk premia strategies

Ilmarinen, PKA and ATP see benefits in strategies that emulate hedge funds over commitment to asset class

-

Asset Class Reports

In-house strategies offer greater advantages

On The Record: Do you use external hedge funds?

-

Analysis

AnalysisAnalysis: Hedge funds brace for CalPERS fallout

Hedge funds are facing a ‘critical period’ in wake of US pension fund’s decision to divest from asset class, writes Christopher O’Dea

-

News

Dutch giant PMT to divest holdings in 'expensive' hedge funds

Pension fund to drop €1bn hedge fund allocation in favour of investments in local residential mortgages

-

News

Hedge funds should be partners, say AIMA and Barclays

Leading investors focusing on knowledge-sharing, co-investment and customisation, says report

-

News

Hedge funds shift attention towards creating ‘institutional credibility’

Industry moving to assuage fears over operational risk, Aite Group survey shows

-

Asset Class Reports

Hedge Funds: Small is beautiful, again

Joseph Mariathasan and Martin Steward note that smaller hedge funds are enjoying significant new inflows for the first time since the financial crisis. Where is the money coming from?

-

Asset Class Reports

Hedge Funds: “We ask investors what they like”

After almost 10 years of talking to hedge fund managers, this is a first. Erich Schlaikjer, co-founder of the Cambridge, UK-based systematic managed futures specialist Cantab Capital, is showing me what his firm’s trading and research systems can do.

-

Asset Class Reports

Hedge Funds: Not such black boxes

David Turner looks at how transparency has improved in the hedge fund world, and what pension funds are doing to adapt to all the new information

-

Asset Class Reports

Hedge Funds: Bottom-up on the up

Changes in market behaviour have created an alpha-rich environment that is great for stockpickers and dangerous for market-timers, write Joseph Mariathasan and Martin Steward