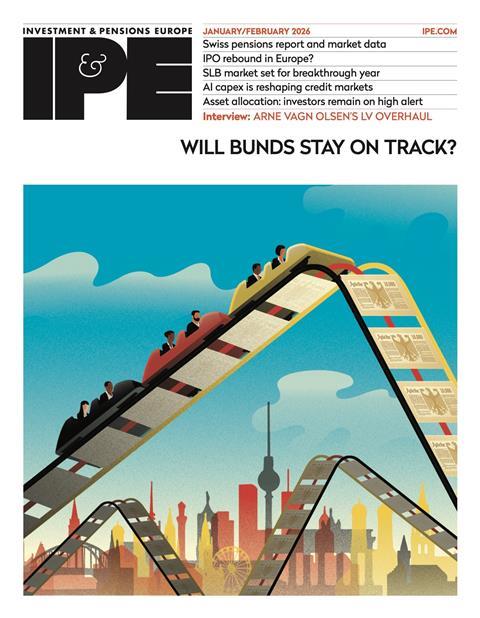

Pension Funds

In-depth analysis and insider intelligence for pension funds. IPE brings you interviews with industry leaders, comprehensive country reports and more

Lyes Arezki outlines UMR's theme-based approach to portfolio construction: ageing and wellness

Lyes Arezki, investment manager for private markets at France’s UMR, sets out the pension provider’s approach to portfolio construction and private markets

Iceland’s LV pension fund pulls off major strategy overhaul

CIO Arne Vagn Olsen explains to Rachel Fixsen how Iceland’s second-largest pension fund has fundamentally changed how it operates

In Depth

Small but perfectly formed: Italy’s €1.6bn Fondo Pensione Pegaso

The pension fund for Italian utility workers taps into private market expertise to broaden its investment horizons and boost returns

Scenarios at the ready: How APG’s chief economist views political risk

Thijs Knaap, APG Asset Management’s chief economist, discusses political risk and how it could affect institutional portfolios

Decision time: Denmark’s Sampension discusses its strategy for European assets

Jesper Nørgaard, deputy CIO at Sampension, discusses whether it is prudent to maintain a large exposure to the US or re-allocate to European equities

- Previous

- Next

Scenarios at the ready: How APG’s chief economist views political risk

Thijs Knaap, APG Asset Management’s chief economist, discusses political risk and how it could affect institutional portfolios

Decision time: Denmark’s Sampension discusses its strategy for European assets

Jesper Nørgaard, deputy CIO at Sampension, discusses whether it is prudent to maintain a large exposure to the US or re-allocate to European equities

PKG Pensionskasse: Investing with discipline and patience

Diego Liechti, the new CIO of PKG Pensionskasse, explains the Swiss pension fund’s investment strategy to Luigi Serenelli as it steps up its exposure to illiquid assets

Pension funds and physical risks: NEST, PFA Pension and PME Pensioenfonds on climate resilience

As the effects of climate change materialise, European pension funds are increasing their focus on physical climate risks

Coller Pensions Institute on a mission to educate developing countries on pensions and savings

David Pinkus and Fiona Reynolds of Coller Pensions Institute tell Liam Kennedy about their plans to foster a pensions and savings culture in emerging and developing countries

Up close in the high north: IPE meets the CEO of Norway state investment fund Folketrygdfondet

Kjetil Houg, CEO of Folketrygdfondet, tells Rachel Fixsen that when Norway’s government decided to dive deep into regional small caps, it created what is probably the world’s most northerly equities team

Fondoposte: New investment strategy, same values for Italian postal workers' pension fund

Antonio Nardacci, chairman of Fondoposte, the pension fund for Italian postal workers, speaks to Luigi Serenelli about the fund’s revamped offering, its domestic investments and ESG