In Depth – Page 19

-

Features

FeaturesIPE Quest Expectations Indicator - April 2021

COVID-19 vaccination figures are rapidly increasing in Europe despite supply problems. Vaccinations are still restricted to vulnerable groups in many countries although the UK is a notable exception. Some countries have imposed new lockdown measures.

-

Features

FeaturesChina: Caught in the crossfire

The investment world is at risk of being caught in the midst of a ‘geoeconomic’ conflict between the world’s main economic blocs

-

Features

Rising interest in EM debt

The weak dollar and low US interest rates are pushing governments and companies in emerging markets (EMs) to issue growing volumes of dollar-denominated debt.

-

Features

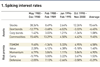

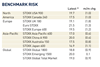

FeaturesHedge funds: Coping with low interest rates

Historical analysis suggests portfolios of certain quant hedge fund strategies may offset some of the risk of rising interest rates

-

Features

FeaturesStrategically Speaking: Capstone Investment Advisors

Last spring’s exceptional market volatility proved the mettle of at least one set of strategies – volatility-focused hedge funds. The CBOE Eurekahedge Tail Risk Hedge Fund index returned a bumper 51.64% in the first three months of 2020 alone against a broad hedge fund market index return of -7.96%, and was up 34.8% for the year.

-

Features

FeaturesFixed Income, Rates, Currencies: Priming the pump

Although COVID-19 infection rates are falling across many regions, the ‘success’ is more a reflection of lockdown restrictions keeping opportunities for virus spread low.

-

Features

FeaturesAhead of the curve: Alternatives investing in a low-yielding world

Investors hoping to replicate bond-like returns (low to mid-single digit, low volatility and drawdown) are facing an unenviable predicament. How can they generate acceptable, positive returns without simultaneously suffering illiquidity, valuation uncertainty, gap risk, and other hard to quantify risks?

-

-

-

Features

FeaturesIPE Quest Expectations Indicator - March 2021

Vaccination figures are rising steadily, but are still at a relatively low level. The US and UK, both important vaccine producers, lead the field with the EU and Japan lagging. As the speed of vaccination has increased, supplies have become a problem, except in the UK. This has caused bad feelings in the EU to the point where a trade war was threatened. New vaccines are in the regulatory pipeline but market shares have largely already been divided in the developed countries. The discovery of new COVID-19 mutations and their resistance to vaccines are an additional risk.

-

Features

FeaturesBriefing: Active ways to prosper in EMs

On the battlefield on which active managers fought their passive enemies for investors’ custom, there was one patch of higher ground that seemed easier to defend – emerging market equities.

-

Features

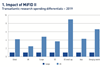

FeaturesBriefing: The sum of all fears

Three years on from the onset of MiFID II, market participants, governments and regulators are assessing its outcomes and considering adjustments.

-

Features

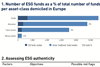

FeaturesBriefing: Tide turning for ESG fixed-income

The supply of ESG-aligned bonds is increasingly underpinned by regulatory pressures and client demand for products targeting non-financial objectives. As the investable universe grows, so the number of funds and assets will increasingly find their way towards fixed-income ESG solutions. However, to strike the right balance between financial and non-financial returns investors should look for ESG-authentic leaders with good risk-return capabilities

-

Features

FeaturesStrategically Speaking: Mondrian Investment Partners

Clive Gillmore is a rarity nowadays among asset management CEOs in that he is keen to discuss what he sees as the difficult moral choices embodied in ESG investment

-

Features

FeaturesFixed Income, Rates, Currencies: Same again in 2021?

The relief from the farewells to 2020, and welcoming a Brexit trade deal, has waned in the face of rising COVID-19 infection rates. There have also been further lockdowns across swathes of Northern Europe as well as in Japan, Thailand, and South Africa to name a few. The vaccine-generated light at the end of the tunnel which appeared last year, seems rather distant, and possibly dimmer too.

-

Features

FeaturesAhead of the curve: Has the period of painless diversification ended?

With interest rates falling to historical lows the reality of a new financial landscape is confronting investors. It is one where the typical relationships between assets has come into question. In addition, basic ideas around diversification and portfolio construction no longer seem to match with the available investment opportunities.

-

-

-

Features

FeaturesIPE Quest Expectations Indicator - February 2021

Interest has shifted from contamination and mortality data to vaccination figures. In this field, the US and UK are doing well, while the EU and Japan are lagging. Political risk is perceived to have gone. Donald Trump’s tendency to self-destruct is creating opportunities for the Republican Party to heal while Democrats are preparing an economic support package.

-

Features

FeaturesBriefing: Still a strong case for US stimulus

The next awaited US stimulus programme remains a mystery. Congress must agree on funding specifics, but the final composition of the Senate will be unknown until this month. Republicans and Democrats have been battling over spending priorities since COVID-19 struck last spring, with competing priorities.