In Depth – Page 27

-

Features

FeaturesIPE Quest Expectations Indicator: August 2019

It looks like political risk is taking a back seat to growth this month, continuing last month’s trend.

-

Features

FeaturesBriefing: Shining a light on active ETFs

Exchange-traded funds (ETFs) have grown into a $5trn (€4.4trn) global industry by focusing on a few key selling points – low costs, liquidity, easy diversification and transparency.

-

Features

Briefing: Guidance for valuation of ILS

Valuation has always been an important, albeit thorny, component in assessing insurance-linked securities (ILS) but the higher-than-expected losses in 2017 and 2018 made the number crunching even trickier. The recently published set of guidelines from the Standard Board of Alternative Investments (SBAI) is designed to improve the process but investors should always be aware of the risks attached to this asset class.

-

Features

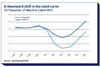

FeaturesBriefing: It is all downhill from here

Six months ago, markets were rediscovering volatility, sentiment was wavering and there were growing fears that we had reached the end of a decade-long bull market for most assets. There were several reasons, such as worries over indicators, global trade tensions and the sustainability of corporate earnings growth, but one of the key ones was the relentless raising of interest rates by the US Federal Reserve.

-

Interviews

Strategically speaking: Montanaro Asset Management

As a Europe-focused small and mid-cap manager, the decision of London-based Montanaro Asset Management to launch its Better World fund, a global impact focused fund after a 27-year track record as a European house, was most certainly a change in strategic direction.

-

Features

FeaturesAhead of the curve: Unlocking new insights

Fundamental investment success involves developing a view on global trends and future market directions as well as identifying relevant investments that are aligned with this strategy. This second step of the process is long and labourious.

-

-

Features

FeaturesIPE Quest Expectations Indicator: June 2019

Last months’ move away from political risk continued this month for the US, the EU and Japan. The UK figures were stable or moving slightly in the opposite direction, reflecting worries over Brexit with the UK body politic in disarray.

-

Features

FeaturesBecoming a mortgage lender

More pension funds are eyeing residential mortgages as an asset class

-

-

Interviews

Strategically speaking: Research Affiliates

Self-described lifelong quant Rob Arnott finds the quantitative-investing industry often guilty of “overhyping and overselling” ideas

-

Features

FeaturesChina: To be or not to be

Investors are divided on whether to classify Chinese equities as a distinct asset class

-

Features

FeaturesBriefing: Emerging markets fail to catch up

Emerging markets have failed to increase their share of global investible market capitalisation since 2007

-

Features

FeaturesBriefing: Looking to active managers

Active management versus passive index tracking remains one of the most hotly contested questions in the world of investment management.

-

Interviews

InterviewsCheyne Capital Management: High-impact debt investor

The growth of non-bank lending in Europe is often mentioned as a trend that could radically transform the European economy. This remains to be seen, but if banks gradually give some of their dominance in the lending market, then firms such as Cheyne Capital Management stand to benefit.

-

Features

FeaturesAhead of the curve: Raising the bar on data privacy

Technology is central to how we live our everyday lives in the world today – it has enabled us to be more connected, more productive and more informed than ever before

-

Features

FeaturesChina tech: Playing BATs versus FAANGs

Chinese tech firms offer exposure to rapidly expanding domestic markets

-

Features

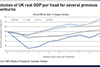

FeaturesMacro matters: Brexit’s challenge for Europe

It is human nature to reduce the complexity of reality to simple rules, simple foci and simple decision points. In this, Brexit is no different

-

Features

Buyouts: Philip Green’s M&S venture

Philip Green, a British retail billionaire, is perhaps best-known for the controversy surrounding the pensions deficit of his defunct BHS high street chain