In Depth – Page 7

-

Interviews

InterviewsSystematic trading for long-term investors

Man Group, the investment management company listed on the London Stock Exchange since 1994, was founded in the City of London in 1783 by James Man as a sugar brokerage firm.

-

Features

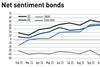

FeaturesIPE Quest Expectations Indicator - February 2024

IPE’s monthly poll of market sentiment, asking 50 asset managers about their six to 12-month views on regional equities, global bonds and currency pairs

-

Features

Insurance-linked securities wind brings good news for investors

In the two decades prior to 2022, the negative correlation between stock and treasury bond market returns has been a key driver of institutional investor portfolio construction. Fixed income allocations provided investors significant relief during equity market downturns and increased expected risk-adjusted returns for the popular 60/40 stock/bond portfolio.

-

Features

FeaturesWill delayed economic bad news hit the market this year?

Global economic growth was below potential in 2023, but still markedly stronger than the forecasts had been indicating at the start of the year, with the US leading the way and even the likes of Europe and the UK, though hardly stellar performers, posting better than expected economic activity.

-

Features

FeaturesNLP can help identify linkages between equity market peers

Natural language processing in AI provides a way to gain insights from unstructured data at scale, allowing access to information across a broad set of investment opportunities

-

Features

FeaturesIPE Quest Expectations Indicator - January 2024

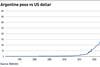

It is safe to predict that 2024 will be a year of desperate campaigning. Political surprises in the US and UK are possible and, this time, they do make a difference to markets

-

Interviews

InterviewsBarings: A bond investor for changing times

Martin Horne is the new global head of public assets at Barings bond investor, but he is a bond guy through and through.

-

Features

FeaturesNet zero’s bond index problem

The fixed-income space has not been short of sustainability innovations over the years.

-

Interviews

InterviewsFiera Capital: Montreal’s succession story

If Fiera Capital were a retail store it might need a big shop window. It is perhaps better known in the institutional world outside Canada for strategies like real assets but Fiera is a full-service asset manager that is also a big deal in its home town of Montreal.

-

Features

FeaturesIs the US economy finally heading for a soft landing?

Having come to terms with the higher-for-longer mantra, markets are grappling with ‘higher-for-even-longer’, as US economic resilience continues to challenge expectations of weakness while reducing the prospects for earlier interest rate cuts from the Federal Reserve.

-

Features

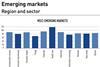

FeaturesQontigo Riskwatch – December 2023

*Data as of 31 October 2023. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants

-

-

Features

FeaturesThe great desyncronisation age in global financial markets

Investors are witnesses to the end of an era of synchronised global growth, when China could be counted on for outsized expansion that provided a broad cross-border lift for economies, industries and asset classes.

-

Features

FeaturesIPE Quest Expectations Indicator - December 2023

IPE’s monthly poll of market sentiment, asking 50 asset managers about their six to 12-month views on regional equities, global bonds and currency pairs

-

Features

FeaturesAvoided emissions: measuring carbon that didn’t enter the atmosphere

A few years ago, a footwear producer’s claim that it was reducing carbon emissions in the economy because its customers walked rather than took the car provoked amusement among investment managers. It wanted to prove its product was healthier and greener than competing transport modes by claiming credit for emissions prevented from petrol use. This autumn, assessments of the role played by individual low-carbon products in replacing fossil fuels are again under scrutiny in the finance sector.

-

Features

FeaturesPrivate debt managers bullish despite uncertainty

When the global financial crisis wreaked havoc across the banking sector, private credit emerged as a potential winner.

-

Features

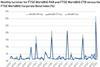

FeaturesMarket volatility: low risk does not mean ‘no risk’

Efforts to produce an accurate estimate of market risk can sometimes turn into a pessimist’s paradise, leading to a paradox. If the outcome of the estimation looks positive, investors might feel that they should not count on it, and if it looks negative, the real outcome will probably be worse than expected. From that perspective, the third quarter of this year was a very unusual one, quantitatively speaking. Not only did both risk and return decline simultaneously – a rare event – but investor sentiment also turned negative during the quarter, ending at its lowest level since the March banking crisis.

-

Features

FeaturesFixed income, rates & currency: interest rates the big question

In August, when Fitch Ratings downgraded US debt from AAA to AA+, it cited an “erosion of governance” as one of the key reasons for its decision. September’s US government shutdown chaos will probably not have improved perceptions of US lawmakers’ proficiency to govern.

-

Features

FeaturesQontigo Riskwatch – November 2023

*Data as of 29 September 2023. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants

-