All Inflation articles – Page 8

-

Country Report

Country ReportInvestment strategy: Asset allocation at a time of uncertainty

Senior investment figures give their views on asset allocation

-

Features

FeaturesFixed income, rates, currencies: Inflation spotlight on central banks

Not often far from the action, central banks have been centre stage in 2022 as one after another in the developed markets reveal their hawkish intents. The speed and synchronicity with which they have shifted has been pretty remarkable, with only the Bank of Japan not yet joining other main central banks.

-

Country Report

Country ReportDutch pension funds tackle inflation

With a nominal liabilities framework under the current FTK rules and a new system around the corner, Dutch schemes are not rushing to inflation-proof their portfolios

-

Asset Class Reports

Asset Class ReportsPortfolio Strategy – Inflation: A new regime

CIOs and asset allocators discuss the effect of inflation on portfolios

-

News

NewsUK, EU DB accounting position broadly favourable, consultants say

Accounting experts at WTW reported discount rates across a range of plan maturities of between 1.8% and 2% per annum

-

News

Alecta sees current volatility creating good credit opportunities

Swedish pension fund reports 24% return for 2021; thanks rising stock markets, strong property market and own work to find fixed income returns

-

News

Dutch pension funds see no need for inflation protection

Inflation figures in the Netherlands are currently among the highest in the euro zone

-

News

PFA predicts 2022 will offer positive equity returns, despite uncertainty

Chief strategist says historic economic recovery ‘does not seem compatible with a continued decline in equities.’

-

News

NewsVirus has created different economic system, says Finnish pensions chief

Governments should channel resources into digitalisation, medicine and other research, says Timo Löyttyniemi

-

News

Security-linked pension promises protect from inflation, interest rate volatility, says Mercer

Pension assets in the DAX 40 increased by around €6bn year-on-year last year to around €286bn

-

News

NewsDanish FSA deems financial sector risks more uncertain, says inflation may last longer

Financial watchdog highlights its efforts to ensure robust pension sector in the face of greater uncertainty about risks.

-

Interviews

InterviewsOn the record: Asset allocation

Three European pension funds discuss their outlook for 2021 and beyond, amid the uncertainty caused by inflation and a new strain of the coronavirus

-

News

Pension funds get go-ahead to contest RPI reform plan in court

Hearing expected to take place in summer 2022

-

News

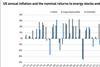

IPE Conference: Risk of economic decline is weighing on central banks

Inflation getting stuck above 2% is going to be a problem everywhere, says BBVA’s Jorge Sicilia

-

Features

FeaturesResearch: DB plans caught in a Catch 22

Pascal Blanqué and Amin Rajan argue that a toxic confluence of demographics, regulation and interest rates are undermining the finances of pension schemes

-

Special Report

Special ReportOutlook: New challenges await

Inflation rising above central bank targets in both the US and Europe threatens the global economy as it recovers from the shock of COVID-19. The impact on interest rates and growth is unclear, leaving investors with a dilemma on their hands. Should they continue to maintain a risk-on stance or raise their defences against potentially higher volatility throughout next year? At this time of uncertainty, IPE asked a selection of CIOs and strategists to comment about their asset allocation priorities for 2022 and beyond

-

Special Report

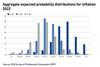

Special ReportThe importance of defining inflation

Investors must reflect on the nature and components of the current rise in inflation

-

Country Report

Country ReportInflation: Schemes keep wary eye on inflation

Few players anticipate rampant inflation rises, but pension funds are atuned to the actions of central banks around the world

-

News

Swedish PFs tell of COVID toll, rising interest rates, benefiting clients

Reduction in DB premiums due to rising interest rates in 2021 and good return on asset side, says Alecta’s head of product

-

News

Healthy UK DB schemes expect to fund 98.3% of accrued benefits

LCP calls on DB schemes to pay more attention to inflation