All Investment Briefing articles – Page 6

-

Features

FeaturesBriefing: Germany finally issues green bonds

There was little doubt that the German finance ministry would eventually tap the green bond market. Germany is committed to reaching net zero greenhouse emissions by 2050.

-

Features

FeaturesBriefing: A time to be calm and focused

The corona pandemic has become an emotional rollercoaster for investors. First, came the market collapse, followed by panic sales. Then, hot on the heels of the turmoil, normalisation and new stock-market highs.

-

Features

Briefing: Timing is everything in distress

After an extended period in the wilderness, distressed debt funds – bereft of opportunities because of ultra-low interest rates and economic buoyancy – are back in the spotlight with large players coming to the market.

-

Features

Briefing: The long march to deleveraging

Global debt reached a new record during the first quarter of this year, reaching 331% of GDP, or $258trn (€229trn), according to the Institute of International Finance, the global association of the finance industry.

-

Features

Briefing: The unbearable lightness of investing

Open the newspaper. Any newspaper. Read the front page and then the money pages. Absorb, assimilate, repeat. After half a dozen goes, a pattern is clear.

-

Special Report

Special ReportSWFs: Never waste a good crisis

Despite pressure on revenues from oil and gas, Arab sovereign wealth funds are taking opportunistic bets in foreign markets in the face of global economic turmoil

-

Features

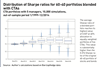

FeaturesHedge funds: ‘Real life’ portfolio evaluation

Outlining an equal volatility-adjusted approach to hedge fund management

-

Features

FeaturesThe Renminbi: A matter of trust

Only a few years ago, there was much hype about the renminbi becoming the next significant reserve currency and potentially even threatening the dominance of the dollar.

-

Features

FeaturesBriefing: Hybrids come into their own

Back in the days when sailors relied on sails, they used to dread the doldrums – that zone near the equator where trade winds converge, generating windless weather.

-

Features

Briefing: Six insights on PE

Considerations for private equity investors in light of the coronavirus pandemic

-

Features

FeaturesBriefing: COVID-19 crisis shines light on private equity tech

It was five years ago that Partners Group’s disaster-recovery team began preparing for a crisis like the one that would shut down all but four of its 20 offices by the end of March.

-

Features

Briefing: A close look at active credit

Research suggests credit mutual funds and hedge funds are not delivering outperformance

-

Features

FeaturesBriefing: Europe turns Japanese

Despite the more immediate concerns of the COVID-19 pandemic, the spectre of ‘Japanisation ’ casts a dark shadow over euro-zone investment markets. It is possible that the current crisis will supercharge the pre-existing trend for Europe to follow Japan’s economic and financial experiences.

-

Features

FeaturesBriefing: A safe haven

Treasuries, the yen, and gold all traditionally serve to harbour investors in times of stress. A closer look at the current demand for Treasuries, however, paints a complex world view with implications for financial markets. Yields suggest it might remain ugly for another decade.

-

Features

FeaturesDollar/sterling: The road ahead for cable

The twisting path of the dollar/sterling relationship over 2020 will provide ongoing theatre, punctuated by moments of intensity

-

Features

FeaturesEmerging market outlook

Emerging markets have a knack for being in the headlines for the wrong reasons. They also stand out as sources of growth for investors who face low interest rates and muted economic performance in the developed world

-

Features

FeaturesBriefing: Central bank about-turn bolsters gold

Gold is unlike any other commodity. It has few industrial applications of any note. It is widely used in jewellery partly because of its aesthetic appeal but also in many cases as a form of investment. Central banks distance themselves from acknowledging the precious metal as a kind of universal currency yet still keep thousands of tonnes of it locked away in their vaults.

-

Features

FeaturesAre cryptocurrencies an asset class for institutional investors?

Cryptocurrencies are sweeping the world in terms of news headlines but how should institutional investors react?

-

Features

FeaturesThe proof of the Brexit pudding is in the eating

Brexit “got done”, to paraphrase the British prime minister, at the end of January. But the exact form it will take is still to be determined

-

Features

FeaturesWhere insurers are placing their money

Insurers’ investment decisions can influence economic growth and developments in capital markets