All Investment Briefing articles – Page 7

-

Features

FeaturesWhen safe haven assets aren’t safe

In the current environment, investors look set to lose money on European government bonds – a quintessential safe-haven asset

-

Features

FeaturesAsset management faces systemic risk questions

When will the next financial crisis hit? Over 80% of respondents among a sample of 500 institutional investors surveyed by Natixis Investment Managers expect a crisis to take place within the next five years.

-

Features

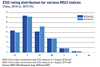

FeaturesChina: On a long climb up the ESG ladder

China is the world’s biggest emitter of greenhouse gases, compels imprisoned Muslims in Xinjiang to toil in factories, and has Communist Party committees embedded in companies, exercising a shadowy influence over management. It is, in other words, not exactly a poster child for good ESG performance.

-

Features

Emerging market debt: Argentina makes investors cry

Who needs Pennywise the terrifying clown when one has Argentine bonds in their investment portfolios?

-

Features

FeaturesBriefing: Peer-to-peer securities lending

The words scale, operational efficiency and lower cost feature regularly in the State Street discussion of its new peer-to-peer securities lending product. Direct Access Lending enables direct, principal loans between its lending clients and its borrowing clients.

-

Features

Ongoing UCITS fees are falling

UCITS are an example of EU financial innovation and a global success story. With €10.1trn in total net assets, UCITS help global investors save for financial goals, including retirement, education, and housing.

-

Features

FeaturesBriefing: Alternatives to large-cap buyouts

Large buyout funds are a staple ingredient in many institutional pension funds’ private-equity portfolios. Focusing on more diversified private-market strategies could be a better way to achieve return objectives

-

Features

FeaturesBriefing: There is still room for growth

Equity investors putting faith in growth stocks – stocks that are priced expensively relative to fundamentals because they are expected to grow fast – received a shock in early September when they sold off sharply.

-

Features

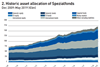

FeaturesGerman Spezialfonds show modest asset growth

Germany’s Spezialfonds market showed modest positive growth in 2018 in the face of challenging market conditions, with total assets approaching €1.5trn.

-

Features

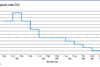

FeaturesBriefing: Draghi’s parting gift on ECB stance

If anyone in Europe was left in any doubt on 11 September about the dovishness of the European Central Bank (ECB) under Mario Draghi’s leadership, by close of business on the next day their doubts were surely dispelled. On that day the outgoing president of the ECB unleashed a bout of monetary easing, in an attempt to boost euro-zone inflation from 1% to its target of “below, but close to, 2% over the medium term”.

-

Features

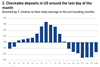

FeaturesBriefing: US makes rapid turnaround

Father Christmas delivered a sack of coal to equity markets last Christmas Eve, with the S&P 500 index losing 1.8%, following a three-day slide. Forecasters had previously been expecting two or three rate hikes in December, as Federal Reserve chairman Jerome Powell steered that discussion. He had mistakenly assumed that the economy had not yet reached a normal, neutral level but it already had, forcing him to backtrack.

-

Features

FeaturesBriefing: Deep tensions threaten EU vision

This is not a commentary on the UK within or without Europe. Brexit has been a compelling distraction but it is one macroeconomic strand in a complex world. The overwhelming coverage has also moved attention away from key internal tensions within the European project.

-

Features

FeaturesBriefing: Coping with lower for much longer

German institutional investors have shifted their asset allocation due to low bond yields

-

Features

Briefing: Sri Lanka after the bombings

The tragic Easter Sunday bombings have devastated tourism, a key plank of the economy

-

Features

Briefing: The cliff-hanger of European banks

It has been a bad decade for European financials, with share prices still a fraction of their pre-crisis highs

-

Features

Briefing: Give credit to CDS indices

DB pension funds could benefit from synthetic credit exposures provided by credit default swap indices

-

Features

FeaturesLiquidity: Bad timing

Pension funds lose billions annually in badly timed trades in the capital markets

-

Features

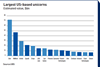

FeaturesIPOs: Unicorn hunting

“Public interest in IPOs hasn’t been this high since the dot-com era of the late 1990s,” say analysts at UBS. Such popularity is stoking fears of a bubble in unicorns – privately-financed start-ups valued at over $1bn (€900m) taking listings.

-

Features

FeaturesBriefing: Shining a light on active ETFs

Exchange-traded funds (ETFs) have grown into a $5trn (€4.4trn) global industry by focusing on a few key selling points – low costs, liquidity, easy diversification and transparency.

-

Features

FeaturesBriefing: It is all downhill from here

Six months ago, markets were rediscovering volatility, sentiment was wavering and there were growing fears that we had reached the end of a decade-long bull market for most assets. There were several reasons, such as worries over indicators, global trade tensions and the sustainability of corporate earnings growth, but one of the key ones was the relentless raising of interest rates by the US Federal Reserve.