All Investment Briefing articles – Page 8

-

Features

Briefing: Guidance for valuation of ILS

Valuation has always been an important, albeit thorny, component in assessing insurance-linked securities (ILS) but the higher-than-expected losses in 2017 and 2018 made the number crunching even trickier. The recently published set of guidelines from the Standard Board of Alternative Investments (SBAI) is designed to improve the process but investors should always be aware of the risks attached to this asset class.

-

Features

FeaturesBecoming a mortgage lender

More pension funds are eyeing residential mortgages as an asset class

-

Features

FeaturesChina: To be or not to be

Investors are divided on whether to classify Chinese equities as a distinct asset class

-

-

Features

FeaturesBriefing: Looking to active managers

Active management versus passive index tracking remains one of the most hotly contested questions in the world of investment management.

-

Features

FeaturesBriefing: Emerging markets fail to catch up

Emerging markets have failed to increase their share of global investible market capitalisation since 2007

-

Features

FeaturesChina tech: Playing BATs versus FAANGs

Chinese tech firms offer exposure to rapidly expanding domestic markets

-

Features

FeaturesMacro matters: Brexit’s challenge for Europe

It is human nature to reduce the complexity of reality to simple rules, simple foci and simple decision points. In this, Brexit is no different

-

Features

Buyouts: Philip Green’s M&S venture

Philip Green, a British retail billionaire, is perhaps best-known for the controversy surrounding the pensions deficit of his defunct BHS high street chain

-

Features

FeaturesCLO supply outstrips demand

Do reports of a growing wariness over collateralised loan obligations (CLOs) mean that the good times are over for the investment vehicle?

-

Features

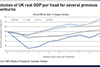

FeaturesUS economy: Overpricing recession risk

Financial markets have suffered a nasty bout of indigestion since October. The interplay of sentiment and volatility induced widespread pessimism, with added concern that market tantrums could subsequently bleed into the real economy

-

Features

FeaturesBriefing: Collateral challenges

Rising interest rates put collateral management strategies to the test

-

Features

FeaturesBriefing: Trade war, a primer

Protectionism is becoming more widespread despite the benefits of free trade being understood for more than two centuries

-

Features

FeaturesBriefing: MiFID II: a year on

The new rules are having a dramatic effect on the world of investment research

-

Features

Liquid Alternatives: The long and the short of it

The long/short liquid alternatives universe is more hetreogenous than some realise

-

Features

Benchmarking: Redefining investment classes

A major GICS index methodology change seeks to reflect underlying market economics

-

Features

Chinese Bonds: Too big to ignore?

Recent tax reforms and the expected inclusion in global indices of Chinese sovereign bonds has shone a spotlight on a vast, under-exploited, multi-trillion bond market

-

Features

Briefing: How to model a trade war

So how does one model the effect of further tariffs on a portfolio? This article shows how to construct a potential trade-war scenario and analyse the impact on a euro-denominated global multi-asset class portfolio

-

Features

Macro Matters: Emerging tensions

Amid all the talk of deglobalisation, certain tenets of the world remain fixed in our minds. Key among these assumptions is the status of the dollar as the global reserve currency.

-

Features

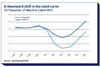

Government Bonds: Snapback risk alert

The Bank for International Settlements has warned bond yields could suddenly rise – a snapback could rapidly spread between bond markets