All articles by Joseph Mariathasan – Page 4

-

Opinion Pieces

Opinion PiecesTrade finance – a sustainable asset class for institutional investors?

Trade financing, according to the Asian Development Bank (ADB) in an analysis from September* “is critical for enabling international commerce and driving international development and poverty reduction”.

-

Opinion Pieces

Opinion PiecesLondon’s Lord Mayor Nicholas Lyons outlines his plan to raise £50bn from pension funds for UK growth assets

The road to hell is paved with good intentions. This aphorism can perhaps well describe the current state of the UK’s investment ecosystem. Despite Europe’s largest pension market at £2.5trn (€2.9trn), the UK economy has been starved of risk capital through a series of legislative and regulatory decisions.

-

Opinion Pieces

Opinion PiecesSustainable agriculture is a growing necessity and institutional investors play a key role

Investment manager PGIM stated in a research note in May: “From farm to fork, our global food system is vast, complex, inefficient and increasingly unfit for purpose.”

-

Special Report

Special ReportAI special report: Could investment management be transformed?

While many foresee a variety of roles for artificial intelligence, critics believe it has a limited role in crucial asset management activities

-

Asset Class Reports

Asset Class ReportsCorporate borrowers in emerging markets put to the test

Many emerging market companies have healthy balance sheets and weathered the COVID crisis well. How will they fare if global growth slows?

-

Features

FeaturesPancakes for lunch with Nobel laureate Harry Markowitz

Harry Markowitz, Nobel Laureate and founder of Modern Portfolio Theory, passed away in June this year. Much has been written about his contribution to the development of modern finance theory. Less, though, on Harry as a person.

-

Asset Class Reports

Asset Class ReportsFixed income & credit – Sustainability-linked bonds

Sovereigns and other issuers are yet to embrace sustainability-linked bonds but issuance is growing

-

Opinion Pieces

Opinion PiecesUK venture capital: spinning out for success

Academic research produces excellent technology and medical firms, but the funding is not always available to take things further

-

Features

FeaturesDigital health revolution ramps up

The world is at the beginning of a digital health revolution. This has been accelerated by the COVID pandemic that forced radical shifts in doctor/patient interactions, and supercharged by the emergence of OpenAI’s ChatGPT that brought generative artificial intelligence (AI) to the forefront and pulled the potential of AI in healthcare into the limelight.

-

Features

FeaturesBlackRock executive pegs inequality with new opportunity index

“Inequality is both a risk and an opportunity that should be measured,” says Gavin Lewis in a conversation about his book ‘The Opportunity Index: A solution-based framework to dismantle the racial wealth gap’. Growing up in a single parent household without a father in Tottenham, a predominantly black area of London with high poverty levels, Lewis is well qualified to have a view on inequality. But as a managing director at BlackRock, is he also an example of the exception that proves the rule?

-

Asset Class Reports

Asset Class ReportsEquities – Does location matter in the corporate listings debate?

The number of listed companies have fallen dramatically, but London remains a preferred global financial centre

-

Country Report

Country ReportUK: Can the country turn a flawed investment ecosytem around?

Decades of complex legislation has fuelled many unanticipated consequences, which has seen pension funds invest less in riskier listed equities and illiquid assets

-

Asset Class Reports

Asset Class ReportsFixed income – Europe's investment-grade market makes a comeback

Investors are showing tentative signs of interest as spreads tighten

-

Features

FeaturesTackling the sustainability conundrum

With climate change and the loss of biodiversity seen as potential existential risks for humanity, it has become imperative to create and implement a sustainable form of capitalism

-

Features

FeaturesThe West should understand the strengths and limitations of Enterprise China

China is fast becoming the West’s bogeyman. Yet a hard decoupling of the two would be a lose-lose situation for both. Despite the tensions, private companies face the challenge of creating viable strategies for interactions with China that could make the difference between success and bankruptcy.

-

Asset Class Reports

Asset Class ReportsEmerging market equities – India’s dancing elephant in the room

Despite challenges with corporate governance and corruption, the prospects for India are too bright to ignore for investors

-

Asset Class Reports

Asset Class ReportsEmerging market equities – Rise of the Gulf equity markets

The Gulf region is changing dramatically and provides growing opportunities for emerging market investors

-

Asset Class Reports

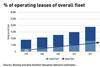

Asset Class ReportsPrivate debt: Leases make plane sense after COVID

With plenty of pent-up demand for air travel, aeroplane operating leases may be an attractive investment option

-

Features

FeaturesCentral banks and the weaponisation of finance

The US has been a global power since the second world war. But it was during the interval between the collapse of the USSR in 1991 and the rise of China in the 21st century that the US was perhaps the single global hegemon.

-

Features

FeaturesFresh views on emerging markets

Despite a large, heterogeneous universe of opportunities across countries that have little or no commonality, risk contagion in the emerging market universe is still an issue, highlighted most dramatically by the 1997 Asian crisis and the risk on/risk off capital movements after the 2007-08 global financial crisis.