All articles by Joseph Mariathasan – Page 6

-

Features

FeaturesJoseph Mariathasan: India’s NPS reaches $100bn in assets

India’s state-run voluntary defined contribution New Pension Scheme (NPS) has reached a milestone of $100bn (€88bn) in assets and is likely to double in size every five years, according to renowned economist Ajay Shah. There are many lessons to be learnt from the success of the NPS, particularly for developing countries seeking to create pension safety nets for their populations from scratch.

-

Asset Class Reports

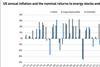

Asset Class ReportsPortfolio Strategy – Inflation: A new regime

CIOs and asset allocators discuss the effect of inflation on portfolios

-

Features

FeaturesJoseph Mariathasan: Avoiding ‘tragedy of the horizon’

Climate change is the “tragedy of the horizon”, warned Mark Carney, then governor of the Bank of England, in a 2015 speech to the insurance market Lloyd’s of London.

-

Asset Class Reports

Asset Class ReportsPortfolio Strategy - Hedge Funds: Juggling the ESG imperative

ESG has the power to transform, but do hedge funds have the drive, data and determination to fit sustainability into their investment process?

-

Asset Class Reports

Asset Class ReportsABS stages a comeback

‘Punitive’ regulations and onerous policies in the wake of the financial crisis saw the ABS market shrink dramatically. But complexity and an illiquidity premium offer opportunities for pension funds

-

Asset Class Reports

Asset Class ReportsUS banks lead a boom in debt issuance

Capital requirements and locking in cheap funding have prompted banks to issue more bonds, but Europe lags behind

-

Features

FeaturesCreating investable opportunities for caring for the elderly

The world is ageing and the liberal democracies in the developed markets are among the fastest in that respect. China, having had 35 years of a one child policy from 1980 to 2015, also faces the challenges of dealing with a rapidly ageing population. Many working adults face a future of caring for two parents and four grandparents as a result.

-

Book Review

Book ReviewBooks: How a small island helped shape modern China’s world view

The Gate to China: A New History of the People’s Republic & Hong Kong by Michael Sheridan, HarperCollins, 2021

-

Asset Class Reports

Asset Class ReportsThe end of social media as we know it?

Increased scrutiny of the power of Facebook, Twitter and Google to influence public opinion may force shareholders to make some uncomfortable decisions

-

Asset Class Reports

Asset Class ReportsTech: Uncertain future as FAANG stocks mature

Innovative tech giants deliver many societal benefits, but concerns over personal data misuse and market power abuse could elicit regulatory responses that inadvertently stifle innovation

-

![Kato Mukuru photo (2)[1]](https://d3ese01zxankcs.cloudfront.net/Pictures/100x67/8/6/6/117866_katomukuruphoto21_973480_crop.jpg) Asset Class Reports

Asset Class ReportsCreating impact in Africa

Companies in Africa traditionally look to private equity to raise capital, providing vast opportunities to PE investors

-

Features

FeaturesSaudi Arabia at the crossroads

As the liberal democracies of the world resign themselves to dealing with the aftermath of the US pull-out from Afghanistan, they face the fact that, as former UK prime minister Tony Blair stated recently, “despite the decline in terrorist attacks, Islamism, both the ideology and the violence, is a first-order security threat”.

-

Asset Class Reports

Asset Class ReportsCo-investment: A capital idea

Co-investment can offer attractive deals to private equity investors but considerable funds are needed to access these opportunities

-

Opinion Pieces

Opinion PiecesCo-investment newcomers need to be selective

The US and UK are seeing a diminishing number of companies in the listed markets whilst the private equity (PE) markets are booming. For investors, that raises a number of issues, of which fees are an important one. Private equity fees are much higher than those of listed equity managers.

-

Opinion Pieces

Opinion PiecesAgriculture: Time to rethink farming

The latest report from the Intergovernmental Panel on Climate Change (IPCC), released in August, provides grim reading. According to the summary for policymakers: “It is unequivocal that human influence has warmed the atmosphere, ocean and land. Widespread and rapid changes in the atmosphere, ocean, cryosphere and biosphere have occurred.”

-

Asset Class Reports

Asset Class ReportsAsset Allocation: Mixed prospects emerging

COVID and political risks may have affected EMs in different ways but there are still many opportunities in such a diverse asset class

-

Special Report

Special ReportPrivate equity: Focus shift brings turmoil to market

China’s focus on ‘common prosperity’ is boosting the importance of ESG factors and generating new opportunities as well as risks

-

Opinion Pieces

Opinion PiecesAfrica’s challenge for Europe

“Europe needs to create a new ‘spice route’ through Africa to the markets of Asia”. That was what Martin Schoeller, managing director of the Schoeller Group, a diversified services company with a focus on sustainability, told me in a discussion on the need for greater European investment in Africa.

-

Opinion Pieces

Opinion PiecesOpportunities beyond the traditional approach to PE

The many thousands of fast-growing small and mid-sized companies globally represent the potential giants of tomorrow, and also provide a fertile hunting ground for those seeking superior investment opportunities.

-

Asset Class Reports

Asset Class ReportsPE is back in the running

The case for more investing in private equity is becoming compelling as the number of listed companies declines