All IPE articles in June 2024 (Magazine)

View all stories from this issue.

-

Features

FeaturesT+1 settlement rules pose challenges for fund managers

A global move to compress settlement cycles – that is, the time between when a transaction is agreed and executed and when the transaction is completed and the securities and cash are exchanged – is underway. While the aim is to deliver lowered risk and cost savings, investors and market participants face challenges due to the increasingly interconnected nature of financial markets.

-

Features

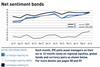

FeaturesMarket predicts US soft landing - June 2024

A combination of Federal Reserve chair Jerome Powell’s press conference and a slightly weaker-than-expected US April non-farm payrolls outcome succeeded in flipping the market back to a soft-landing narrative for the US economy. US Treasury bonds rallied sharply, taking other markets with them, while the yen weakened significantly against the dollar before recovering.

-

Country Report

Country ReportNordic Region Report 2024: Denmark’s government urges pension funds to support defence

Danish schemes embrace defence – as long as ESG criteria and international conventions are adhered to

-

Features

FeaturesIPE Quest Expectations Indicator - June 2024

Trump and Biden are both losing to undecided voters, a group that is now unusually large and may be sensitive to Trump’s legal troubles. Biden’s approval rate is below his score in presidential polls, while Trump’s score is the same in presidential polls and those measuring voters’ opinion of him. In the UK, the Conservatives took another drubbing in the local elections.

-

Features

FeaturesWhy investors should focus on Scope 3 emissions

The investment industry is preoccupied with reducing Scope 1 and 2 emissions in portfolios to meet net-zero commitments. However, this focus will not provide a way to effectively manage climate transition and physical risk.

-

Country Report

Country ReportSweden’s AP7 adapts by expanding asset classes and boosting staff numbers

Under new leadership, Sweden’s default fund in the premium pension system is expanding asset classes and personnel

-

Opinion Pieces

Opinion PiecesWhy Norway's rebuff to oil fund over private equity is all about pay and equality

It would be hard to argue that Norway’s sovereign wealth fund is not diversified, but its range of permitted asset classes is narrower than that of peers.

-

Opinion Pieces

Opinion PiecesDespite their differences, pension funds should continue to act as bold corporate stewards

This year’s voting season leaves questions about the benefits of engaging with companies in the sectors that are slowest to embrace the climate transition.

-

Special Report

Special ReportRoundtable: AEIP - Simone Miotto

Taking into consideration that pension design is a national competence, and therefore a responsibility of the member states, the European Commission must retain high-level social policies in its next term and continue to engage with stakeholders.

-

Asset Class Reports

Asset Class ReportsSmall-cap equities struggle as giants surge ahead

Small caps are finding it difficult to make inroads in a world dominated by the Magnificent Seven

-

Opinion Pieces

Opinion PiecesHow AI is making inroads in America's retirement industry

Artificial intelligence (AI) is starting to gain traction in the retirement industry, even if it is still early days.

-

Opinion Pieces

Opinion PiecesWhat happens if we burn all the carbon?

As someone who started his career working for Shell International (albeit four decades ago when fossil-fuel-induced global warming was not an issue that we were aware of), I do not believe that oil companies are inherently evil.

-

Special Report

Special ReportRoundtable: APG Asset Management - Onno Steenbeek

Regarding the prioritisation of policies by the next European Commission to strengthen European pensions, it is clear that addressing the challenges presented by an ageing population and ensuring sustainable, adequate pension systems must be a priority.

-

Opinion Pieces

Opinion PiecesThe art and science of investor collaboration in the quest for effective stewardship

In the evolving landscape of sustainable investment strategies, the significance of engagement has become more pronounced in recent years. Traditionally seen as supplementary to investment processes, stewardship has transformed into an indispensable tool for achieving meaningful environmental and social change.

-

Opinion Pieces

Opinion PiecesAustralian super funds push back on lacklustre energy transition proposals by corporates

Australian and global pension funds orchestrated an unusually vocal tactical campaign against the climate-transition action plan of Woodside Energy, a global oil and gas producer, in the lead-up to its 70th annual general meeting in late April.

-

Special Report

Special ReportRoundtable: Avida International - Dorothee Franzen

Since the 2012 European Commission white paper on pensions, ensuring both the adequacy of pension systems and their financial sustainability over the long term have been the key and mutually intertwined goals of the EU’s pension policy. These principles are no less relevant now.

-

Special Report

Special ReportRoundtable: Eversheds Sutherland - Eric Bergamin and Francois Barker

Many pension rules have their origins in European legislation. The European Commission wants every EU citizen to be able to build up an adequate pension to avoid a poverty trap among the elderly, and also wants solid consumer protection.

-

Opinion Pieces

Opinion PiecesDisagreements between Germany's coalition partners cloud occupational pensions reform

Pension reforms have taken centre stage in the latest row among the coalition partners in the German government.

-

Analysis

AnalysisEurope's pension bodies struggle to make their voice heard on blanket EU rules

Horizontal regulation does not take into account the peculiarities of retirement schemes

-

Special Report

Special ReportRoundtable: CBBA-Europe - Francesco Briganti

It is acknowledged that the IORP II directive is currently under revision, and it is likely that additional requirements will be introduced in new legislation. The European Commission should not introduce additional requirements regarding solvency, governance, information, or reporting because IORPs already work well.