Latest from IPE Magazine

-

Country Report

Country ReportPensions in Switzerland report 2026: Swiss franc strength forces domestic pension funds to adopt costly hedging strategies

The Swiss franc is seen as a safe haven in times of trouble, but its strength causes problems for the country’s pension funds

-

Asset Class Reports

Asset Class ReportsFixed income report 2026 - Germany’s spending spree: safe bet or bumpy ride for Bund investors?

The German government’s landmark decision to increase public spending beyond its traditionally strict limits meant that Bunds had a volatile ride last year. This scenario has already become a familiar one for investors, as shown by the 2.5 basis points (bps) jump in the 10-year bond yield that kickstarted 2026.

-

Country Report

Country ReportSwiss pension funds eye private markets with caution

Hesitation about private equity is counterbalanced by investor demand for infrastructure and domestic real estate assets

-

Asset Class Reports

Asset Class ReportsTech takes over: how AI capex is reshaping credit markets

Cash-rich issuers are rushing to the IG market to finance AI-related expenditure. But with spreads at tight levels, markets will be closely watching earning statements and balance sheets

-

Country Report

Country ReportRisks mount for Swiss pension funds’ AT1 bond portfolios

These bonds remain marginal in Swiss pension funds’ portfolios, but some retain their holdings despite growing default risks and potential future legal battles

-

Asset Class Reports

Asset Class ReportsBond managers look to AI to boost returns

The new tech is flooding financial markets, but has made a slow start in bonds. This is about to change, as industry players work towards improving data quality and oversight of AI applications

-

Asset Class Reports

Asset Class ReportsSustainability-linked bond market looks for 2026 breakthrough

The SLB market faced setbacks in 2025, but also showed signs of progress. After a string of missed targets, issuers will be setting more realistic ambitions, potentially benefiting the asset class

-

Country Report

Country ReportSwitzerland’s Ethos Foundation gets tough on governance

Sophie Robinson-Tillett interviews the Ethos Foundation’s Vincent Kaufmann

-

Asset Class Reports

Asset Class ReportsTokyo resilience bond sparks demand among European investors

A groundbreaking deal out of Tokyo suggests strong investor appetite for climate resilience bonds, with the potential for many more transactions in 2026 and beyond

-

Country Report

Country ReportWho’s who in the Swiss pension industry

With more than 1,300 pension funds, affiliated to a vast array of public and private company employees, Switzerland’s pension fund industry is diverse and complex. Here is a selection of some of the most prominent professionals within an industry that manages nearly €1trn of assets

-

Interviews

InterviewsIceland’s LV pension fund pulls off major strategy overhaul

CIO Arne Vagn Olsen explains to Rachel Fixsen how Iceland’s second-largest pension fund has fundamentally changed how it operates

-

Interviews

InterviewsLyes Arezki outlines UMR's theme-based approach to portfolio construction: ageing and wellness

Lyes Arezki, investment manager for private markets at France’s UMR, sets out the pension provider’s approach to portfolio construction and private markets

-

Features

FeaturesIPE Quest Expectations Indicator – January 2026: Equities win managers’ vote

The pessimism around equities prevailing last summer has evaporated

-

Research

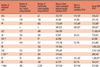

ResearchIPE institutional market survey: Fiduciary, OCIO & outsourcing 2026

IPE’s annual fiduciary management, OCIO and outsourcing survey covers packaged advice and implementation services provided by investment management or consultancy firms to institutional investors.

-

Special Report

Special ReportFiduciary assets plateau as UK market matures

UK pension schemes are de-risking through insurance in growing numbers, while many are choosing run-on strategies – and fiduciary managers must adapt

-

Asset Class Reports

Asset Class ReportsEuropean equities: IPO market set for rebound amid policy uncertainty

A renaissance in European stockmarket flotations needs to be backed by more supportive policies

-

Opinion Pieces

Opinion PiecesPension funds must resist the weaponisation of asset allocation

Concerns about geopolitics are one of many factors involved in pension funds’ asset allocation decisions - yet they are often overemphasised by outsiders

-

Opinion Pieces

Opinion PiecesPension funds are under the spotlight – it should be seen as an opportunity

Global policymakers are looking to pension funds to be part of the solution to many problems

-

Opinion Pieces

Opinion PiecesSustainable capitalism should ditch Milton Friedman’s flawed approach

Nobel Prize-winning economist Milton Friedman’s influence on corporate behaviour and investment philosophy continues to resonate decades after his famous 1970 New York Times article declaring that the sole social responsibility of business is to increase profits.

-

Opinion Pieces

Opinion PiecesThoughtful engagement with AI is not longer an option for asset managers and pension funds

The arrival of AI into the investment process has the potential to vastly amplify existing research-related information disparitie