Latest from IPE Magazine – Page 100

-

Features

FeaturesBriefing: Active ways to prosper in EMs

On the battlefield on which active managers fought their passive enemies for investors’ custom, there was one patch of higher ground that seemed easier to defend – emerging market equities.

-

Features

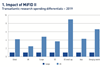

FeaturesBriefing: The sum of all fears

Three years on from the onset of MiFID II, market participants, governments and regulators are assessing its outcomes and considering adjustments.

-

Features

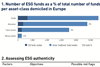

FeaturesBriefing: Tide turning for ESG fixed-income

The supply of ESG-aligned bonds is increasingly underpinned by regulatory pressures and client demand for products targeting non-financial objectives. As the investable universe grows, so the number of funds and assets will increasingly find their way towards fixed-income ESG solutions. However, to strike the right balance between financial and non-financial returns investors should look for ESG-authentic leaders with good risk-return capabilities

-

Features

FeaturesStrategically Speaking: Mondrian Investment Partners

Clive Gillmore is a rarity nowadays among asset management CEOs in that he is keen to discuss what he sees as the difficult moral choices embodied in ESG investment

-

Features

FeaturesFixed Income, Rates, Currencies: Same again in 2021?

The relief from the farewells to 2020, and welcoming a Brexit trade deal, has waned in the face of rising COVID-19 infection rates. There have also been further lockdowns across swathes of Northern Europe as well as in Japan, Thailand, and South Africa to name a few. The vaccine-generated light at the end of the tunnel which appeared last year, seems rather distant, and possibly dimmer too.

-

Features

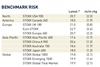

FeaturesAhead of the curve: Has the period of painless diversification ended?

With interest rates falling to historical lows the reality of a new financial landscape is confronting investors. It is one where the typical relationships between assets has come into question. In addition, basic ideas around diversification and portfolio construction no longer seem to match with the available investment opportunities.

-

-

-

Features

FeaturesIPE Quest Expectations Indicator - February 2021

Interest has shifted from contamination and mortality data to vaccination figures. In this field, the US and UK are doing well, while the EU and Japan are lagging. Political risk is perceived to have gone. Donald Trump’s tendency to self-destruct is creating opportunities for the Republican Party to heal while Democrats are preparing an economic support package.

-

Opinion Pieces

Opinion PiecesSocial purpose: the new dimension

Investors’ attention turned to human capital issues in 2020 as COVID-19 took hold – including the treatment of staff and other stakeholders, as well as dividend policy and executive pay in cases where companies have received taxpayer support.upport.

-

Country Report

Country ReportCEE – Poland: Auto-enrolment limps to the finishing line

Lack of trust underpins poor take-up of new plans

-

Asset Class Reports

Asset Class ReportsAsset class report – Investment grade credit

The US credit market is heading for change under new President Joe Biden’s administration

-

Special Report

Special ReportDefined contribution: The engagement fallacy

The idea that successful defined contribution (DC) pension solutions require a high level of member engagement is being questioned

-

Features

FeaturesBriefing: Japan emerging from its invisible lockdown

Japan is all too often portrayed as being different from other countries. Not just distinctive in the obvious sense that every country has its own national peculiarities. Instead, somehow unique in a way that makes it stand out from every other country.

-

Opinion Pieces

Opinion PiecesJapan is not that different

One of the abiding myths about Japan is that it is different from everywhere else. Not just distinctive in the sense that all countries have peculiarities but uniquely different.

-

Country Report

Country ReportCEE – Croatia: Real diversification

A lack of local diversification opportunities is holding back Croatian pension funds

-

Special Report

Special ReportDefined contribution: ESG not enough to get young on board

Engaging younger savers with their defined contribution pension pots requires far more than just an up-to-date responsible investment policy

-

Asset Class Reports

Asset Class ReportsInvestment Grade Credit: Always a demand for quality

Capital markets are fluctuating between optimism and pessimism

-

Features

FeaturesBriefing: Still a strong case for US stimulus

The next awaited US stimulus programme remains a mystery. Congress must agree on funding specifics, but the final composition of the Senate will be unknown until this month. Republicans and Democrats have been battling over spending priorities since COVID-19 struck last spring, with competing priorities.

-

Opinion Pieces

Opinion PiecesThe real meaning of engagement

Empirical evidence suggests that individuals are unengaged with DC pensions. This is demonstrated by the vast majority of DC members remaining in default funds and reluctant to increase contributions.