Latest from IPE Magazine – Page 103

-

Features

FeaturesLong term matters: A time to be hopeful and active?

Jaap van Dam, principal director of investment strategy at PGGM, is right: pension funds need to understand politics. We have two additions. First, the ‘outside-in’ focus – how politics affects portfolios – is a great starting point. But investors cannot stop there, they have considerable influence on politics whether for good or bad.

-

Interviews

InterviewsOn the record: Outlook 2021

Heading towards the end of one of the most challenging years ever for the global economy, IPE asked three institutional investors about their outlook for 2021

-

Interviews

InterviewsHow we run our money: Germany's BVK

André Heimrich (pictured), CIO of the Bayerische Versorgungskammer (BVK), and his team speak to Carlo Svaluto Moreolo about the pension fund’s global diversification strategy

-

Features

FeaturesUS endowments: Success breeds success

Perhaps no single group of institutional investors elicits as much fascination and admiration as US university endowments – in particular those of the Ivy League, and among that elite group the Yale and Harvard endowments in particular.

-

Opinion Pieces

Opinion PiecesGuest viewpoint: Sir Ronald Cohen

We are on the threshold of another major shift in institutional portfolios. Impact transparency is changing the rules for both investors and businesses.

-

Opinion Pieces

Opinion PiecesIs sustainability mispriced?

Living in the developed world over the past 50 years, life has been stable, even idyllic, for most people. That is certainly compared with their grandparents and previous generations who lived through two world wars and the Spanish flu. But, as COVID-19 has shown so cruelly, there are existential dangers that can lie hidden. These can rip the established world order asunder if not tackled beforehand.

-

Features

FeaturesAccounting Matters: Accounting for the Wedge

The reason why defined benefit (DB) scheme sponsors account for inflation is because International Accounting Standard 19, Employee Benefits, tells them that if they make a benefit promise that is linked to price increases, the effect of that commitment has to be accounted for. The starting point for what by any standards is a gargantuan actuarial task is to look at yields on inflation-linked bonds.

-

Opinion Pieces

Opinion PiecesLetter from Australia: Reforms not super for default funds

A string of government reforms due to come into effect from July 2021 has caught the superannuation sector off-guard.

-

Opinion Pieces

Opinion PiecesLetter from US: COVID-19 places new demands on university endowments

COVID-19 has hit a special category of institutional investors in the US hard – college and university endowments. In fact, higher education institutions are facing a decline in revenues because of fewer students enrolling and paying tuition, as well as current students asking for more financial aid. Colleges and universities are withdrawing substantial amounts from their endowments to cover these extra expenses. How is this affecting endowments’ investment strategies?

-

Opinion Pieces

Opinion PiecesPerspective: Markowitz is still modern

Thirty years after he was awarded the Nobel Memorial Prize in Economic Sciences, Harry Markowitz’s groundbreaking work from the 1950s still powers financial innovation

-

Features

FeaturesResearch: Resilience is the new watchword

In the first of two articles, Pascal Blanqué and Amin Rajan ask whether the current volatility in asset prices is a buying opportunity or the halfway stage in a prolonged bear market?

-

Features

FeaturesStrategically Speaking: BlueBay Asset Management

Nowadays, it seems fair to ask asset managers whether they believe they can fulfil their clients’ needs while at the same time doing their bit to fight COVID-19.

-

Features

FeaturesFixed Income, Rates, Currencies: Vaccine boosts bullish markets

The swings in outcome predictions as the vote counting began in the US election were large. From the realisation that there was no blue wave of Democrat success, to a possible re-election for Donald Trump, to a Joe Biden win but with a Republican Senate, it was tricky to comprehend the investment implications.

-

Features

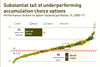

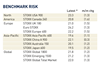

FeaturesAhead of the curve: Grasping intangible assets

Even the name hints at the challenge: intangible assets are hard to value. Recently, investors have looked to these assets to explain a decade of underperformance by value stocks. But new research suggests no tangible performance benefit from adjusting for intangibles.

-

-

-

Features

FeaturesIPE Quest Expectations Indicator - December 2020

US COVID-19 case numbers were rising rapidly at the time of writing. Western European figures suggest that the lockdowns are repelling the second wave. Japan’s statistics suggest a third wave is coming. Only an efficient vaccination and a high participation in inoculation programmes can end the threat posed by COVID-19.

-

Features

FeaturesBiden signal is green for ESG

For many, US president-elect Joe Biden spells hope. From an ESG-perspective, there are two main aspects to this phenomenon.

-

Country Report

Country ReportSwitzerland: The road to digital pensions

From letters still sent by pension funds, to apps and portals, the road to digitise the Swiss pension system looks long but promising

-

Asset Class Reports

Asset Class ReportsPrivate markets – Private equity: the impact of COVID-19

The pandemic has devastated some sectors while boosting others