Latest from IPE Magazine – Page 105

-

Interviews

InterviewsHow we run our money: Lothian Pension Fund

Bruce Miller (pictured), CIO at the Lothian Pension Fund, talks to Carlo Svaluto Moreolo about the fund’s inclination towards equities and internal management

-

Country Report

Country ReportSpain: COVID triggers reviews

Nothing could have prepared Spain for the turmoil of 2020

-

Special Report

Special ReportFiduciary Management: Reshaping the pensions landscape

Mandatory tendering in the UK market has fuelled rapid growth in the fiduciary management industry

-

Interviews

InterviewsStrategically Speaking: State Street Global Advisors

In the quaint English game of cricket, there exists a concept that provides a good metaphor for the predicament facing the world in 2020.

-

Opinion Pieces

Opinion PiecesLeading viewpoint: How great companies deliver purpose and profit

Shareholder value creation is good for companies, investors and the wider world

-

Opinion Pieces

Opinion PiecesSmart phones: the key to African opportunity

Demographics are often the least appreciated of the long-term trends that investors consider, despite being perhaps the most important.

-

Features

FeaturesAccounting Matters: Who sets the standards?

You are what you know, the saying goes. And it goes without saying that the 211 comment letters the International Accounting Standards Board (IASB) received on its Primary Financial Statements (PFS) project will represent some diverse viewpoints.

-

Opinion Pieces

Opinion PiecesLetter from US: Gold investment returns to favour

“Negative real interest rates and unconventional monetary policies have been the catalyst of the new-found interest in gold,” says Jim McKee, a gold expert at Callan’s alternatives consulting group.

-

Features

FeaturesPerspective: Manager selection in a pandemic

The social distancing restrictions imposed to contain COVID-19 have made external asset manager selection more demanding, but investors are adapting

-

Opinion Pieces

Opinion PiecesGuest Viewpoint: Five reasons to invest in pensions technology

The world has changed exponentially in 2020, leading many multinationals to ask valid questions about how they can enhance their global operations.

-

Features

FeaturesFixed Income, Rates, Currencies: Economy reaches tipping point

The global reflation trade, and with it the outlook for further dollar weakness, seems paused as speculation on the outcome of the imminent US presidential election diverts attention and has many retreating to neutral positions.

-

Features

FeaturesAhead of the curve: Gold all set to shine during uncertain times

Which asset has no cash flow or yield, has a volatility similar to equities even though its long-term performance lags behind equities, and which has also had long periods of negative returns? Gold.

-

-

-

Features

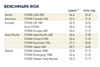

FeaturesIPE Quest Expectations Indicator - November 2020

The two overriding concerns for global markets are the resurgence of COVID-19 cases in many parts of the world and the US elections. In relation to the pandemic it is impossible to know exactly when it will be brought under control. In the US there is a real chance that Joe Biden will win the presidency and the Democrats gain a majority in the senate.

-

Opinion Pieces

Opinion PiecesLetter from Australia: Funding the future world

A handful of Australian superannuation funds are committing their members’ savings to the future world in terms of energy, water, technology and ideas. There will be successes and failures as ideas are developed and marketed.

-

Opinion Pieces

Opinion PiecesLeading viewpoint: Why we fiduciaries are failing younger members

Small adjustments are not enough: we need to reimagine our approach

-

Opinion Pieces

Opinion PiecesLeading viewpoint: Rethinking materiality: the missing link

Materiality is the missing link between sustainability reporting, corporate strategy, risks and the UN’s Sustainable Development Goals

-

Opinion Pieces

Leading viewpoint: Letter to the top

A letter to the top 100 heads of ESG at global asset managers

-

Opinion Pieces

Opinion PiecesLeading viewpoint: Closing ESG reporting gaps

Asset managers seeking a coherent ESG strategy first need a coherent narrative