Latest from IPE Magazine – Page 108

-

Interviews

InterviewsStrategically Speaking: Insight Investment

Insight Investment’s asset management roots are in the structural shift over the past two decades to closed-book defined benefit (DB) pensions in the UK and elsewhere.

-

Features

FeaturesPensions first in move toward UK mandatory climate risk reporting

Mandatory reporting in line with the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) has long been a topic of discussion in the UK. It is almost hard to believe that a definitive move to make it policy is only a few months fresh.

-

Interviews

InterviewsHow we run our money: KLP

Aage Schaanning (pictured), chief financial officer at Norway’s Kommunal Landspensjonskasse (KLP), talks to Carlo Svaluto Moreolo about the fund’s risk framework

-

Features

FeaturesAccounting Matters - UK DB pension schemes: One step forward, two steps back

As sometimes happens with Easter, one of the surveys of the UK pensions accounting landscape from consultants Lane Clark & Peacock (LCP) was later than usual. And, like an Easter egg, this keenly awaited overview of the net funding position of FTSE 100 defined benefit (DB) pension schemes comes in two halves.

-

Opinion Pieces

Opinion PiecesLetter from Australia: ESG stirs some ancient ghosts

In May this year, Rio Tinto blew up one of Western Australia’s most significant Aboriginal heritage sites.

-

Opinion Pieces

Opinion PiecesLetter from US: All eyes on CalPERS as CIO quits

The $405bn (€342bn) California Public Employee’ Retirement System (CalPERS) is the bellwether of US public pension funds.

-

Features

FeaturesPerspective: What is trusteeship worth?

Running a pension fund is a difficult job, whether for an executive, a professional trustee, or a member-nominated representative

-

Opinion Pieces

Opinion PiecesGuest ViewPoint: Peter Laurelli, eVestment

Comparing asset management fees across firms, strategies and regions is not a simple task. There are frequently differences, sometimes large, in what asset managers state they charge in their marketing materials, and the fees they actually negotiate during due diligence and selection processes.

-

Features

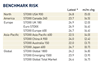

FeaturesFixed income, rates, currencies: Reality gap widens

August 2020 saw the US Treasury market post one of its worst monthly performances since November 2016, while global equities, led by the US, reached new highs.

-

Features

FeaturesAhead of the curve: COVID-19 and short-termism: finding the right balance

Finding a way to meet short-term needs without compromising long-term strategy has never been easy for businesses. The radical uncertainty introduced by COVID-19 has made the task much harder.

-

-

Features

FeaturesIPE Quest Expectations Indicator October 2020

Globally, net equity sentiment is close to record levels, while net bond sentiment is flat or down to near record levels. A scenario explained by a virtual consensus that central banks can continue to pump liquidity into the system and this will eventually kickstart economies. Meanwhile, economists are predicting a long and deep slump.

-

Opinion Pieces

Opinion PiecesA long sunset on a fragile model

The ECB’s move in September 2019 to lower rates and restart corporate bond purchases was a clear red warning signal to defined benefit pension funds and other liability-driven investors.

-

Country Report

Country ReportNetherlands: New paths

The new Dutch pension agreement could unleash a new wave of thinking around risk taking and portfolio construction, with strong similarities to the way some Nordic schemes are run

-

Special Report

Special ReportEU sustainable finance: Impact uncertain

New EU climate benchmarks are getting industry take-up but not everyone is embracing them

-

Special Report

Special ReportChina: First in, first out

China is focusing on a new long-term growth strategy after the success of its tough measures to contain the coronavirus outbreak

-

Asset Class Reports

Asset Class ReportsEquities – Pandemic winners and losers

COVID-19 is proving a powerful catalyst for social and technological change

-

Special Report

Special ReportTop 1000 Pension Funds 2020: Europe’s €8trn pension pot

This year’s 7.25% increase in overall assets for IPE’s Top 1000 European Pension Funds 2020 sample to €8.3trn must inevitably be seen in light of 2019’s strong year for asset returns and 2020’s tumultuous COVID-19-related market crash. By comparison, the overall asset increase in 2019’s survey was 6.93%.

-

Features

Briefing: Timing is everything in distress

After an extended period in the wilderness, distressed debt funds – bereft of opportunities because of ultra-low interest rates and economic buoyancy – are back in the spotlight with large players coming to the market.