Latest from IPE Magazine – Page 110

-

Special Report

Special ReportFrance: Reforms freeze in face of pandemic

Economic damage inflicted by COVID-19 halts plans to unify France’s 42 second-pillar schemes

-

Special Report

Special ReportGermany: Saving occupational pension schemes

The second pillar is being targeted with a series of regulatory and political measures to keep it intact

-

Analysis

AnalysisEcology: A car crash in nature

Vian Sharif, head of sustainability at FNZ Group, never imagined her recently completed PhD thesis would have implications for global health. The subject was the trade in endangered animal products such as the scales of pangolins.

-

Features

FeaturesLong term matters: Tales of a chance ESG investor

I didn’t intend to get a permanent job in ‘responsible investment’: my pitch for a consulting contract got misfiled in a recruitment folder and the rest really is history. Having held two good jobs in the sector, at USS and Axa Investment Management, I appreciate the 12 years I’ve spent inside the investment world.

-

Analysis

Research: Stewardship – a key point of competition

In the second of two articles on a new survey, Amin Rajan and Simon Klein argue that climate-change investing is mandating asset managers to be agents of change

-

Interviews

InterviewsOn the record: Crisis talks

IPE asked three pension funds how they implemented their crisis communication strategies during the COVID-19 emergency

-

Interviews

InterviewsHow we run our money: comPlan

Roman Denkinger (pictured), head of asset management at comPlan, tells Carlo Svaluto Moreolo about managing the fund’s portfolio during the COVID-19 crisis

-

Special Report

Special ReportIceland: Focus turns to the homefront

Pensions funds heed a call by the government to concentrate on domestic investment to boost the economy

-

Interviews

InterviewsStrategically speaking: Saker Nusseibeh, Federated Hermes

At first sight, the two sides of Federated Hermes seem culturally distinct. Federated is a staid, family-controlled, and Pittsburgh-based money manager with a history of providing services to bank trust departments. Hardly a hotbed of ESG or shareholder engagement, you might think.

-

Features

Accounting matters: Totalling the sub-totals

A project that at its simplest is about the layout of financial statements should be uncontroversial. But the International Accounting Standards Board’s Primary Financial Statements project faces a potentially big test.

-

Opinion Pieces

Opinion PiecesLetter from US: Diversity in asset management rises

“It is a part of your fiduciary duty to invest the fund’s assets in a prudent manner. Investing with diverse asset managers that demonstrate outperformance and deliver strong returns is more than prudent, it is wise.”

-

Book Review

Book ReviewBooks: It all boils down to the three Ds

Paul Marshall’s pocket guide to fund management covers multiple subjects, each of which really deserves its own book. Nonetheless, he writes well, and has produced a diverse and entertaining work.

-

Opinion Pieces

Opinion PiecesGuest Viewpoint: The growing influence of index providers

Pension funds have shifted assets worth hundreds of billions from actively managed funds to passive funds in recent years. In doing so, they are part of an ongoing money mass-migration from high-fee active funds to low-fee index funds.

-

Features

FeaturesPerspective: How to survive a reputational crisis

Pension fund trustees could benefit from developing a clear policy stance in relation to controversial questions

-

Features

FeaturesFixed income, rates, currencies: Still facing anxious times

Developed market government bond yields have spent the summer drifting lower as risk assets traded better. However, this benign climate has not lifted the fog of confusion caused by COVID-19.

-

Features

Ahead of the curve: Alternative data offers insight

The measures required to stop the spread of COVID-19 – social distancing and government-mandated lockdowns – mean that, unlike in previous recessions, services have led the economic decline.

-

-

-

Features

FeaturesIPE Quest Expectations Indicator September 2020

US COVID-19 figures are receding, to the extent that Brazil has taken over as the world’s worst managed country. A number of western European countries are experiencing a minor rebound, likely because of holiday travel. India has suffered a high death toll but this is partly a reflect of its huge population.

-

Opinion Pieces

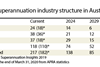

Opinion PiecesLetter from Australia: Pooling for savings and strength

The government, the regulator and economic fallout from COVID-19 have combined to pressure Australia’s large and unwieldy pool of super funds towards consolidation.