Latest from IPE Magazine – Page 112

-

Special Report

Special ReportInvestment services: CSDR's long and winding road

A new settlement regulation for central securities depositories has been delayed amid industry concerns and lack of clarity

-

Asset Class Reports

Asset Class ReportsCredit: Interest grows in Chinese bonds

Foreign investors are finding Chinese government bonds increasingly attractive

-

Country Report

Country ReportItaly's recovery: Endless opportunities for pension funds

Italian pension funds are primed to participate in Italy’s post-COVID-19 recovery

-

Features

FeaturesThe Renminbi: A matter of trust

Only a few years ago, there was much hype about the renminbi becoming the next significant reserve currency and potentially even threatening the dominance of the dollar.

-

Opinion Pieces

AGMs: Setting new ESG standards

As the AGM season comes to an end for another year, it is worth reflecting upon the high pressure that company boards are facing from investors to take greater account of environmental impact, diversity and executive pay – only a few issues from a long list of environmental, social and governance (ESG) criteria that most investors now seem to abide by.

-

Special Report

Investment services: Blending your benchmarks

New conditions are demanding a more sophisticated approach to benchmark blends

-

Asset Class Reports

Credit: PGGM - A partnership approach

PGGM has taken its credit-risk-sharing strategy a step further by forging a partnership with Sweden’s Alecta

-

Country Report

Country ReportItaly: Funds go private

Italy’s institutional investors have kept their focus on private markets during the COVID-19 crisis

-

Features

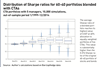

FeaturesHedge funds: ‘Real life’ portfolio evaluation

Outlining an equal volatility-adjusted approach to hedge fund management

-

Country Report

Country ReportItaly: IORP II in limbo

The EU’s IORP II directive has yet to be fully implemented by Italian pension funds

-

Features

FeaturesInvestment Strategy: Towards sustainable portfolio theory

This year marks the 30th anniversary of the 1990 Nobel prize in Economics given to Harry Markowitz, William Sharpe and Merton Miller. IPE is marking this in several ways. The first event took place at the IPE annual conference in Copenhagen in December 2019, with a panel discussion following on from the showing of a delightful video. The video was based on a few days that TOBAM CEO Yves Choueifaty and I spent with Markowitz in his office in San Diego in June of that year and showed Markowitz’s charm and humility despite his great achievements.

-

Features

FeaturesLong term matters: Risk calls for universal investors

I’m looking for a senior executive from a major institutional investor who has “systemic risk” in their job description.

-

Features

Research: The rise of climate investing in passive funds

COVID-19 is a devastating reminder of the fragility of life on Earth. It will be a key defining force of change in our age, alongside global warming.

-

Interviews

InterviewsOn the record: Safety in asset-backed credits

Simon Davy, head of private markets at the UK’s Local Pensions Partnership, discusses the outlook for alternative credit

-

Features

FeaturesEU sustainability focus shifts

EU sustainable finance policy-making began with a vengeance in 2018, when the European Commission unveiled and embarked on its Action Plan for Financing Sustainable Growth. Two years later, the Commission is preparing to adopt a new, “more ambitious and comprehensive” sustainable finance strategy.

-

Features

FeaturesStrategically Speaking: Asoka Woehrmann, DWS

DWS has just unveiled a new, simplified global structure. CEO Asoka Woehrmann explains how the reorganisation will allow the firm to focus on its key business lines

-

Features

FeaturesAhead of the curve: Liquidity has been the litmus test for China’s bond market

It is no safe haven, but China has provided bond investors with important shelter through the storm

-

Interviews

InterviewsHow we run our money: ENPAB

Danilo Pone, CIO of ENPAB, the first-pillar scheme for Italian biologists, talks about the fund’s new proprietary asset allocation model

-

Features

Accounting Matters: Controversy over sponsor rebates

In 2014, staff at the International Financial Reporting Standards Interpretations Committee (IFRS IC) – the body responsible for developing guidance on the application of IFRSs – recommended the approval of an amendment to its asset-ceiling guidance.

-

Opinion Pieces

Opinion PiecesLetter from Australia: Paltry pickings in the political pie

As deficits mount in a post-COVID-19 world, politicians and bureaucrats are again eyeing national pension savings – hundreds of billions of dollars they can capture at the stroke of a legislative pen.