Latest from IPE Magazine – Page 118

-

Features

FeaturesAhead of the curve: Can the system win in EMs?

Systematic investment models have been commonplace in equity markets. Can they generate returns in emerging market debt?

-

Special Report

Special ReportBribery and corruption: Sustainability’s nemesis

SDG 16.5, covering bribery and corruption, is central to other SDGs but hard to tackle in practice

-

Analysis

AnalysisPensions accounting: A matter of survival

If there is one thing DB scheme sponsors and trustees can be sure of this year, the COVID-19 pandemic is going to affect not only their ability to fund schemes but also how they account for them

-

Analysis

AnalysisFixed income, rates, currencies: Thinking on one’s feet

The enormous scale of national lockdowns has made it hard to keep abreast of all the extraordinary monetary interventions and fiscal support packages worldwide.

-

Opinion Pieces

Opinion PiecesLetter from US: Short-term relief, long-term pain

The COVID-19 pandemic is having an immediate and transparent impact on American defined contribution plans. But it also has implications for defined benefit plans in the long run

-

Opinion Pieces

Opinion PiecesGuest Viewpoint: Jeremy Coller

The global shutdown is painful for almost every sector of the economy. But in some industries the real damage will begin after the pandemic ends

-

Features

FeaturesBriefing: Long-term investing: it’s up to the pension board

A practical framework for pension fund trustees looking to implement long-term investment approaches

-

Features

FeaturesBriefing: COVID-19 crisis shines light on private equity tech

It was five years ago that Partners Group’s disaster-recovery team began preparing for a crisis like the one that would shut down all but four of its 20 offices by the end of March.

-

Features

Briefing: A close look at active credit

Research suggests credit mutual funds and hedge funds are not delivering outperformance

-

-

-

Features

FeaturesIPE Quest Expectations Indicator May 2020

Using last month’s model of the statistics on daily new cases as an early indicator and daily case mortality as evidence of policy change, the 21 April situation looks like:

-

Opinion Pieces

Opinion PiecesKnowns and unknowns

“There are known knowns; there are things we know we know. We also know there are known unknowns; that is to say we know there are some things we do not know. But there are also unknown unknowns – the ones we don’t know we don’t know.” Donald Rumsfeld, former US secretary of defence, February 2002

-

Country Report

Country ReportGermany & Austria: Do social partners pensions have a future?

The implementation of social partner pensions between employer and trade unions has yet to take off

-

Special Report

Special ReportPensions tech: Fine-tuning the options for multinationals

ADA fintech software enables multinational pension schemes to weigh up a vast range of data and information

-

Special Report

Special ReportPrivate and green: Non-listed sustainable debt

The market for non-listed debt with green or sustainability features is growing fast

-

Features

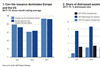

FeaturesBriefing: Europe turns Japanese

Despite the more immediate concerns of the COVID-19 pandemic, the spectre of ‘Japanisation ’ casts a dark shadow over euro-zone investment markets. It is possible that the current crisis will supercharge the pre-existing trend for Europe to follow Japan’s economic and financial experiences.

-

Features

FeaturesFixed Income & Credit: Credit at a crossroads

How will weak lending standards hurt credit investors in a global slowdown?

-

Country Report

Country ReportGermany & Austria: ESG and alternatives rise up the agenda

German pension funds are embracing ESG and alternative assets in the search for improved yield

-

Special Report

Special ReportDashboard tech: How AI can transform pensions

Dashboard technology like Moneyhub has the potential to prompt consolidation in UK DC pensions