Latest from IPE Magazine – Page 124

-

Special Report

Special ReportPEPP: Time to get personal

Can the new Pan-European Personal Pension Product close Europe’s pensions gap?

-

Asset Class Reports

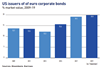

Asset Class ReportsFixed Income – European investment grade: No sign of end for negative yields

Negative interest rates look set for a lengthy run in Europe, raising concerns about the long-term effects

-

Country Report

Country ReportBaltic private equity: Faith in the new

BaltCap is championing business integration in the Nordic and Baltic economies

-

Special Report

Special ReportBehaviour and retirement planning: Live long and prosper

Most retirement planning models simplify people’s life patterns

-

Asset Class Reports

Asset Class ReportsUS investment grade: A year for not living dangerously

Geopolitical uncertainties are pushing investors away from longer-term strategies

-

Country Report

Country ReportEstonia: Reforms face opposition

Proposals designed to strengthen the Estonian first pillar are proving controversial

-

Special Report

Special ReportUK: More needs to be done to address post-retirement challenges

The industry has been slow to address the challenges posed by pension freedoms

-

Asset Class Reports

Asset Class ReportsBuilding ABS confidence

European regulators are promoting a ‘gold standard’ for asset-backed securities

-

Country Report

Country ReportRomania: Still under threat

Political decisions have damaged Romania’s second-pillar system. How will it respond to a change of government and a bullish stock exchange?

-

Special Report

Special ReportUK auto-enrolment: Solutions needed for retirees

Auto-enrolment for employees has been a success. Why not take the same approach for retirees?

-

Country Report

Country ReportRussia puts a spotlight on pension age

Low levels of trust in financial services have scuppered plans to reform the pension system

-

Opinion Pieces

Opinion PiecesA precarious balance

Why has there not been another global financial crisis over the past decade? That is a more fruitful question than trying to predict when the next bout of market mayhem will hit.

-

Opinion Pieces

Opinion PiecesSystemic risk may be underestimated

Underestimating the scale of systemic risk within the asset management industry is a mistake. For several years, macroprudential authorities including the International Monetary Fund, the European Central Bank and the Bank of England have argued that asset management activities are becoming systemically more risky.

-

Opinion Pieces

Opinion PiecesTime for a positive impact on investing

The focus on sustainability and impact investing is expected to continue to grow, with potential regulatory and policy responses having wide-ranging investment implications

-

Analysis

AnalysisInvestors react to EU Green Deal

PensionsEurope and EFAMA have reacted positively to a European Commission climate change-driven growth strategy

-

Interviews

InterviewsInterview: Miranda Carr, Haitong International

It is all too easy to forget that the markets are in a peculiar state. For example, nominal yields on US 10-year Treasuries have trended downwards since 1981. Real interest rates – that is, adjusted for inflation – have also trended downwards from about the same time. Estimates vary but there are also many trillions of euros worth of negative yielding debt.

-

Interviews

InterviewsOn the Record: Retirement income

IPE asked three pension funds how they help members to ensure investment returns are turned into good retirement outcomes

-

Interviews

InterviewsHow we run our money: Xerox UK Final Salary Pension Scheme

Jeffrey McMahon, head of pension investment and risk at Xerox UK, tells Carlo Svaluto Moreolo about the plan to make the company’s legacy DB scheme self-sufficient

-

Features

FeaturesChina: On a long climb up the ESG ladder

China is the world’s biggest emitter of greenhouse gases, compels imprisoned Muslims in Xinjiang to toil in factories, and has Communist Party committees embedded in companies, exercising a shadowy influence over management. It is, in other words, not exactly a poster child for good ESG performance.

-

Features

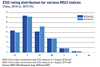

FeaturesESG Report: SAAving the world?

Integrating ESG has become commonplace in institutional investment, but generally the discussion has focused on areas such as security selection and stewardship