Latest from IPE Magazine – Page 125

-

Interviews

InterviewsStrategically speaking: QMA

QMA’s CEO Andrew Dyson explains why current market dislocations arguably represent the biggest investment opportunities of the last decade – if not of the last 25 years – for value investors

-

Features

FeaturesPerspective: Carlo Cottarelli

Carlo Cottarelli, the Italian economist and former IMF director, says fixing the European economy will mean taking difficult decisions

-

Opinion Pieces

Opinion PiecesGDP numbers spread fake news

GDP is a measure of economic activity rather than wealth creation. As such, it can give misleading signals about the health of an economy

-

Features

FeaturesAccounting Matters: Inflation measurement dilemma

If there is one issue that has seized the attention of defined benefit (DB) sponsors this reporting season, it is whether inflation should be measured using the consumer prices index (CPI) or the retail prices index (RPI). And Lane Clark & Peacock (LCP) partner Alex Waite is clear why: “There is a formula [for RPI] and the formula is wrong. It is like having an error in a spreadsheet,” he says.

-

Opinion Pieces

Opinion PiecesLetter From US: Concerns over common ownership unabated

No matter who wins the presidential election this November the issue of concentration of US corporate ownership by the Big Three money managers – BlackRock, Vanguard and SSGA – will not go away

-

Analysis

AnalysisResearch: Back to basics will drive asset allocation

In the final article on a new report, Pascal Blanqué and Amin Rajan conclude that liquidity management has become vital as quantitative easing reaches a point of diminishing returns

-

Opinion Pieces

Opinion PiecesGuest Viewpoint: Fabrice Demarigny, Joachim Nagel & Corien Wortmann-Kool

“A reboot of the CMU has moved up the European policy agenda”

-

Features

FeaturesDutch hedging strategies: Dynamic approaches in favour

Levels of interest rate hedging cover used by Dutch industry-wide pension funds vary widely, according to figures published late last year by pensions supervisor De Nederlandsche Bank (DNB).

-

Features

FeaturesPensions depositaries: IORP II’s new consolidation option

European pensions legislation raises the possibility of a new kind of consolidation vehicle that could also accommodate large Dutch mandatory industry-wide pension funds

-

Features

FeaturesHow to improve EIOPA’s stress test

EIOPA’s 2019 stress tests already included substantial improvements, but the cash flow analysis could be improved further

-

Features

FeaturesAsset management faces systemic risk questions

When will the next financial crisis hit? Over 80% of respondents among a sample of 500 institutional investors surveyed by Natixis Investment Managers expect a crisis to take place within the next five years.

-

Features

FeaturesWhen safe haven assets aren’t safe

In the current environment, investors look set to lose money on European government bonds – a quintessential safe-haven asset

-

Features

FeaturesFixed income, rates, currencies: Better than expected

Although packed with geopolitical surprises 2019 turned out to be better than expected for financial assets. Equities and bonds rallied together reversing last year’s ‘unusual occurrence’ of both performing badly.

-

Features

FeaturesAhead of the Curve: Measuring the right thing

The old adage, ‘measure twice, cut once,’ only works if you measure the right thing. The prominence of GDP growth as the ultimate gauge of economic performance, for example, is increasingly a case of measuring the wrong thing. A single metric cannot hope to capture all the complex trends that develop below the surface of a modern knowledge and services-based economy.

-

-

-

Features

FeaturesIPE Quest Expectations Indicator: January 2020

Bond sentiment remains stable, but still negative. US net bond sentiment is edging towards zero, which is surprising as the Fed is set on neutral.

-

Opinion Pieces

Can we all be Canadian?

As we approach the 2020s, what have we learned about pension investing in the last 20 years?

-

Special Report

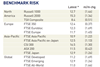

2020 Investment Horizons: Emerging markets face contagion

The protracted period of ultra-low interest rates in the developed world could have a nasty knock-on effect on emerging market debt

-

Asset Class Reports

Asset Class ReportsPrivate Equity: Finding the right metric

It is hard to compare the performance of private equity investments