Latest from IPE Magazine – Page 127

-

Book Review

Book review: Only the Best Will Do

Peter Seilern, the founder of Seilern Investment Management, has a reputation for investing in ‘quality growth companies.’ In reading his credo ‘Only the Best Will Do,’ you realise this career-long passion reaches almost religious dedication. Never mention ‘value investing’ in his presence.

-

Features

Perspective: Ontario Teachers' Pension Plan

As he ends a six-year stint at the helm of Ontario Teachers’ and prepares for retirement, Ron Mock reflects on the alignment of interests between the organisation and its stakeholders

-

Features

FeaturesResearch: Pension investors seem to be losing faith in quantitative easing

In the first of two articles on a new survey of pension plans, Pascal Blanqué and Amin Rajan find that unconventional monetary policy has taken a toll on pension funds

-

Interviews

On the record: Is private equity lagging behind the ESG curve?

IPE asked three pension funds how private equity managers are progressing in terms of integrating responsible investment

-

Features

FeaturesiTDFs: A formula to end retirement blues?

All over the world, the financial industry is grappling with the ‘ideal’ post retirement investment strategy and with how best to pay out income in retirement. There is an arms race and the question is the following: who will win the retirement agenda?

-

Features

Emerging market debt: Argentina makes investors cry

Who needs Pennywise the terrifying clown when one has Argentine bonds in their investment portfolios?

-

Features

Ongoing UCITS fees are falling

UCITS are an example of EU financial innovation and a global success story. With €10.1trn in total net assets, UCITS help global investors save for financial goals, including retirement, education, and housing.

-

Features

ESG: UK regulator turns sights on climate disclosures

With environmental risks taking a more central role in investment strategies, regulators have also been looking at what actions they can take.

-

Interviews

Strategically speaking: Scientific Beta

I am probably a little bit uncompromising,’’ says Noël Amenc, the founding CEO of Scientific Beta, the provider of factor indices and strategies. To those who know him that is an understatement.

-

Features

FeaturesBriefing: Peer-to-peer securities lending

The words scale, operational efficiency and lower cost feature regularly in the State Street discussion of its new peer-to-peer securities lending product. Direct Access Lending enables direct, principal loans between its lending clients and its borrowing clients.

-

Asset Class Reports

Asset Class ReportsIntangible assets – Dealing with intangibles

The global growth of companies with relatively limited physical assets presents challenges for investors

-

Features

FeaturesAsset Allocation: Good news buoys risk markets

Several factors have given risk markets a boost and propelled risk-free rates higher. These include diminishing fears of an economic slowdown, a potential rapprochement in trade negotiations and a reduced risk of a ‘no-deal’ Brexit.

-

Features

FeaturesAhead of the Curve: Value investing in the next decade

Winds of change are blowing relentlessly across the globe and the investment world is no exception. Central to this evolution is the growth of intangible assets, ranging from brands and patents to franchise agreements and digital platforms.

-

-

Interviews

How we run our money: Pension Danmark

Torben Möger Pedersen , CEO of PensionDanmark, tells Carlo Svaluto Moreolo that he sees the Danish pension provider as part of an improved Scandinavian welfare system

-

Features

FeaturesIPE Quest Expectations Indicator: December 2019

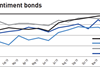

With the shift to a strong negative bond sentiment in the UK, markets have again split. For the UK and EU, the figures are more negative and trending down.

-

Opinion Pieces

Letter from the US: US pension funds braced for lower for longer

The last edition of the International Monetary Fund’s (IMF) twice-yearly Global Financial Stability Report (GFSR) points to the risks that lower-for-longer yields pose, especially for pension funds.

-

Opinion Pieces

Guest viewpoint: Bob Collie

“With DC now globally dominant, the momentum that has been building is likely to continue”

-

Opinion Pieces

Opinion PiecesBold thinking needed

Muted and constrained economic growth, continued low yields and quantitative easing, combined with a poor investment return outlook, loom over Europe’s pension sector.