Latest from IPE Magazine – Page 131

-

Special Report

Liquidity & Implementation: Woodford fallout renews focus on ETF risks

The recent suspension of redemptions from Neil Woodford’s Equity Income fund is a cautionary tale and one that has further sharpened the spotlight on the liquidity of mutual funds, a category that includes exchange-traded funds (ETFs).

-

Special Report

Liquidity & Implementation: Liquid beta sleeves: bespoke solutions with index building blocks

Liquidity in a pension fund context can mean a number of things. As long-term investors, pension funds can harvest the illiquidity premia by investing in private markets, which they have been doing increasingly over the past 10 years.1 On the other hand, pension funds are required to meet their liabilities and so need enough liquidity to ensure the payment of benefits to members.

-

Special Report

Liquidity & Implementation: Will all mutual funds become ETFs?

It took almost five years, but the US regulator still surprised many in the exchange-traded fund (ETF) industry when it gave preliminary approval to Precidian Investments’ ActiveShares in May.

-

Special Report

Liquidity & Implementation: A cost comparison: futures versus ETFs

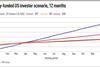

In this article, we use a cost comparison framework to contrast index futures (CME Group’s E-mini S&P 500 index futures) and three popular US-listed exchange-traded funds (ETFs) tracking the same index – SPY, VOO and IVV.

-

Special Report

Liquidity & Implementation: The shifting sands of index provision

As ETFs are created to track ever more specialised market exposures, competitive pressures and new regulations are impacting the complex relationships between asset managers and index providers.

-

Special Report

ETFs for ESG: Why passive makes sense for ESG

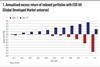

ESG investing – the incorporation of environmental, social and governance (ESG) factors into investment criteria – has grown rapidly in recent years.

-

Special Report

ETFs for ESG: The ESG governance challenge

An increasing number of institutional investors are interested in investments with an environmental, social and/or governance (ESG) focus.

-

Special Report

ETFs for ESG: Sustainable investing is here to stay

Sustainable investing was once viewed as a trade-off between value and ‘values’. Yet today, it’s something investors can no longer afford to ignore.

-

Special Report

ETFs for ESG: The devil in the detail of ‘low carbon’ ETFs

Sustainable market indices are nothing new. The Dow Jones Sustainability index was launched in 1999 and the FTSE4Good index in 2001.

-

Special Report

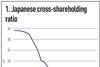

ETFs for ESG: Corporate governance for passive investors in Japanese equities

The Japanese economy has been experiencing significant and positive change since the election of Prime Minister Shinzo Abe in 2012. After a sustained period of economic stagnation, Japan’s return to growth is being fuelled by Abe’s transformative economic policies.

-

Special Report

ETFs for ESG: Gender equality ETFs gain a foothold

Can a new category of ETFs help address one of the oldest economic imbalances of all?

-

Special Report

Focus on Fixed Income: The rise and rise of fixed income ETFs

When ETFs first broke up the active management party in the fallout of the financial crisis, it was equity funds that bore the brunt of the impact.

-

Special Report

Focus on Fixed Income: ETFs: the natural home for fixed income

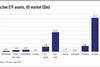

In recent years, fixed income ETFs have been grabbing a larger slice of the ETF market as investors look to capitalise on the enhanced diversification, tradeability, price transparency and liquidity they can provide to bond portfolios. According to the latest research by Citi Business Advisory Services, fixed income ETF assets have increased at a robust 25% annual compound growth rate over the last decade, hitting more than $870bn by the end of 2018.

-

Special Report

Focus on Fixed Income: Do fixed income ETFs distort the market?

In this article, which is an excerpt from a recent State Street Global Advisors publication, we address one of the key misconceptions about fixed income (bond) ETFs – namely, that they have become so large that they are distorting the underlying bond market. Instead, we argue, despite their recent growth, fixed income ETFs represent a relatively small proportion of the world’s debt markets.

-

Special Report

Focus on Fixed Income: Bond ETFs, the Swiss army knife in a time of need

Fixed income will play both a pivotal and multi-faceted role in European pensions scheme portfolios. Whether it be for growth, income or liability and cash flow matching, many schemes in the region will need to hold bonds as they de-risk in a low yield environment.

-

Special Report

Focus on Fixed Income: Actively managing today’s green bond opportunities

In this article we examine the process for green bond labelling and certification and its implication for index investors. Passive (index-tracking) green bond funds are bound by eligibility rules and each index has its own labelling requirements.

-

Special Report

Markets & Regions: Factor investing in commodities: a sector-based approach

Commodities have long been a staple of multi-asset investors. Traditionally used to diversify exposure to fixed income and equity holdings, they are more recently also a source of alternative risk premia. Whatever the use case, the desired feature of any commodities allocation is some combination of attractive performance, sufficient liquidity, and a transparent methodology.

-

Special Report

Markets & Regions: China unleashed: taming the dragon through ETFs

Despite its favourable fundamentals and widely acknowledged growth potential, China continues to be under-owned by most global investors.

-

Special Report

Innovation: What could disrupt ETFs?

Over the last two decades, exchange-traded funds (ETFs) have been one of the most disruptive forces in the asset management industry. But could the tables be turned? In an era of excitement over the possibilities of financial technology (fintech), are ETFs vulnerable to being displaced themselves?

-

Special Report

Innovation: Bringing ETFs into the digital future

Over the past 18 months there has been an explosion in the number of ETFs focusing on new technology. From iShares to Ossiam, DWS to veteran investor Jim Rogers, it seems everyone has launched a fund based on how digitisation will revolutionise our lives.