Latest from IPE Magazine – Page 136

-

Opinion Pieces

Opinion PiecesLetter from Canada: Considering controversy

Pension funds have essentially one goal – invest and grow the fund for members. But what if money-making investments run afoul of environmental, social and governance practices?

-

Opinion Pieces

Opinion PiecesGuest viewpoint: Tracy Blackwell, Pension Insurance Corporation

The financial services industry is one of the least trusted in the UK. The Purpose of Finance project aims to address issues of trust and reform

-

Special Report

Ireland: A pension reform battleground

The government’s plan to overhaul the entire pension system is running behind schedule

-

Special Report

Italy: Prioritising early retirement

The 2019 budget allocated funds to allow more favourable early retirement but its impact has been limited

-

Special Report

Netherlands: Transition path to a new system

The latest agreements between stakeholders and a relaxation of rules bring pension reform closer

-

Special Report

Norway: New public sector scheme agreed

A hybrid framework is set to boost competition in the municipal pensions market

-

Special Report

Portugal: Scene set for broad changes

Pension reform advances with new rules and proposals by the Portuguese government

-

Special Report

Spain: Reforms on hold

Chronic political instability has turned attention away from pension reform while features of previous legislation have been undone

-

-

Special Report

Switzerland: Let’s try this again

The Swiss government is to present a social security pension reform bill in the autumn, including some measures rejected by the public in 2017

-

Special Report

UK: Thinking beyond Brexit

Pensions regulation has taken a backseat to Brexit but this has not stopped the industry from moving ahead with changes

-

Features

FeaturesRelative response to liquidity issues

Equity risk is a crucial portfolio exposure for pension funds and a key driver for long-term retirement outcomes for pension plans and their beneficiaries. Yet the structure of equity markets is in transition, which changes the way pension funds choose to allocate capital to them.

-

Special Report

Liability Strategies - Consolidator funds: New tools, new models

Can consolidator funds provide an additional tool for UK pension schemes approaching the defined benefit endgame?

-

Special Report

Special ReportInvestment services: Accessing China's bond market

Access to China’s fixed-income market is cheaper and easier than ever

-

Features

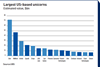

FeaturesIPOs: Unicorn hunting

“Public interest in IPOs hasn’t been this high since the dot-com era of the late 1990s,” say analysts at UBS. Such popularity is stoking fears of a bubble in unicorns – privately-financed start-ups valued at over $1bn (€900m) taking listings.

-

Asset Class Reports

Asset Class ReportsUS equities: Past, present and future

Are US equity valuations in bubble territory?

-

Country Report

Country ReportPrivate equity: Visions of the future

Is Project Iris, a joint effort by Italian pension funds to invest in alternatives, a sign of things to come?

-

Features

FeaturesThe Disneyworld trap

The remarkable reversal in the outlook for official interest rates over the past few months has received relatively little attention. Until recently it was widely accepted that rates could only move upwards. It looked almost certain that quantitative tightening (QT) would supplant quantitative easing (QE). Now the balance has reverted to further monetary accommodation.

-

Special Report

Special ReportCDI takes root

Matching and cashflow strategies are gaining ground around continental Europe, sometimes with a green tinge

-

Special Report

Special ReportCredit default swaps: A bridge too far

The practice of managed defaults – in which otherwise solvent companies deliberately default on their debt – has prompted moves towards tighter regulation