Latest from IPE Magazine – Page 139

-

Special Report

Special ReportTop 400: Cultures change

Is asset management a tech business, a people business, or both? As the sector pushes new frontiers, much of the attention has been on vast sums the sector needs to invest in technology. This, combined with the burden of new regulation, is making investment management a more cost intensive business and driving M&A

-

Special Report

Indices and Benchmarks: The Chinese dam breaks

Global bond indices have started including the Chinese domestic bond markets in their benchmarks

-

Asset Class Reports

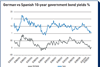

Asset Class ReportsGovernment Bonds - Euro-zone: Turning Japanese

The euro-zone appears to be in a low-growth liquidity trap redolent of Japan

-

Features

FeaturesNo going back

There is no going back to the days when the key political divide was between mainstream left and right

-

Special Report

Technology: Disparities impede EU progress

The EU is not achieving its true potential on the global technology stage because it is still not operating as a fully fledged single market

-

Features

Briefing: Guidance for valuation of ILS

Valuation has always been an important, albeit thorny, component in assessing insurance-linked securities (ILS) but the higher-than-expected losses in 2017 and 2018 made the number crunching even trickier. The recently published set of guidelines from the Standard Board of Alternative Investments (SBAI) is designed to improve the process but investors should always be aware of the risks attached to this asset class.

-

Special Report

Special ReportEuropean benchmarks: Meet Sonia, €STR and Saron

European interest rate benchmarks reform will bring new challenges for asset managers and investors

-

Special Report

Special ReportMulti Boutiques

Can multi-affiliate boutique structures combine the benefits of consolidation with the cultural advantages of smaller, focused managers?

-

Country Report

Denmark: Schemes challenge regulator on guarantee

Regulatory developments and the low-interest-rate environment are pushing pension funds to move away from guaranteed schemes

-

Asset Class Reports

Asset Class ReportsUS Treasuries – still safe?

Rising US government debt levels are posing a conundrum for bond investors

-

Features

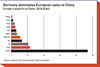

FeaturesEurope belatedly turns eastwards

The EU’s lack of a common strategy to respond to the rise of China as an economic superpower suddenly came to the fore earlier this year, as Italy joined China’s Belt and Road Initiative (BRI).

-

Special Report

Special ReportChina: Befriending the dragon

Italy’s decision to join China’s Belt and Road Initiative has prompted criticism from the EU and the US

-

Features

FeaturesBriefing: It is all downhill from here

Six months ago, markets were rediscovering volatility, sentiment was wavering and there were growing fears that we had reached the end of a decade-long bull market for most assets. There were several reasons, such as worries over indicators, global trade tensions and the sustainability of corporate earnings growth, but one of the key ones was the relentless raising of interest rates by the US Federal Reserve.

-

Special Report

Special ReportThe origin of ESG indices

What does the proliferation of sustainable benchmarks mean for passive ESG investing?

-

Special Report

Special ReportArtificial intelligence: Let me tell you what you really think

How are managers deploying natural language processing to analyse management sentiment in earnings calls?

-

Country Report

Sweden: Reform focus turns to quality and cost

Phase two of Sweden’s premium pension system reform aims to weed out poor investment pension funds and preserve the best

-

Features

FeaturesDC’s collective voice could be decisive

Australian pension funds could soon become the biggest shareholders in their country’s equity market (see page 5), with researchers at Rainmaker Information forecasting their combined domestic stock holdings to hit 60% by 2033.

-

-

Special Report

Special ReportESG: Weight of evidence

There is no consensus on a positive link between ESG and improved portfolio performance

-

Country Report

Country ReportPer Bolund: Green future for Swedish pensions

Sweden’s financial markets minister tells Pirkko Juntunen that the government is preparing for comprehensive pension reform