Latest from IPE Magazine – Page 140

-

Special Report

Special ReportSuccessful investment firms don’t dodge industry realities

Culture is a big differentiator in determining the successful asset managers of the future

-

Country Report

Iceland: Full overhaul on the cards

Iceland’s government is preparing for a comprehensive review of pension fund issues

-

-

Country Report

Norway: Paving the way for competition

Municipal reform and proposed new public-sector scheme is creating a fertile environment for competition

-

-

-

Book Review

Book ReviewBook review: The Rise of the Working-Class Shareholder

David Webber is well placed to rehearse the legal and political arguments around public pension funds’ power to change companies

-

Features

FeaturesInterview: Sharon Bowles – A forensic assessment

The former chair of the European Parliament’s Economic Affairs Committee talks to Stephen Bouvier

-

Opinion Pieces

Opinion PiecesLong-term matters: Exxon’s AGM – can investors learn from the slave trade?

English evangelical protestants allied with the Quakers initiated the campaign to abolish the UK slave trade in the early nineteenth century. Two centuries later, the Vatican has said that climate change is a “moral and religious imperative for humanity”. Will the fate of fossil fuel companies be defined by public, sovereign and religious investors? And can other investors watch from the sidelines?

-

Interviews

InterviewsOn the Record: Tough times at home

We asked two pension funds to share their views about investing in Europe at this crucial juncture for its economy

-

Interviews

InterviewsHow we run our money: CPEG

Grégoire Haenni, CIO of CPEG, the public pension fund for the Swiss canton of Geneva, explains the fund’s multidimensional approach to asset allocation

-

Interviews

Strategically speaking: Montanaro Asset Management

As a Europe-focused small and mid-cap manager, the decision of London-based Montanaro Asset Management to launch its Better World fund, a global impact focused fund after a 27-year track record as a European house, was most certainly a change in strategic direction.

-

Features

FeaturesFixed income, rates, currencies: Politics remains the bellwether

Financial markets continue to be influenced by news, and tweets, about the US-China trade negotiations. While stock markets have sold off during the second quarter of 2019, and credit spreads have widened, this financial tightening is so far less than what happened over the last few months of 2018.

-

Features

FeaturesAhead of the curve: Unlocking new insights

Fundamental investment success involves developing a view on global trends and future market directions as well as identifying relevant investments that are aligned with this strategy. This second step of the process is long and labourious.

-

-

Special Report

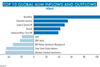

Special ReportTotal global AUM 2019

All the asset managers featured in the Top 400 ranked by worldwide and external institutional assets under management. Assets managed by these groups total €66.4trn (2018: €65.7trn)

-

Features

FeaturesInterview: Haukur Hafsteinsson, LSR

The government pensions veteran bids farewell to LSR, Iceland’s largest pension, after 34 years as its chief executive

-

Features

ESG: Evolving non-financial reporting

This month, the European Commission is due to release guidelines on climate-related reporting by companies.

-

Features

FeaturesIPE Quest Expectations Indicator: June 2019

Last months’ move away from political risk continued this month for the US, the EU and Japan. The UK figures were stable or moving slightly in the opposite direction, reflecting worries over Brexit with the UK body politic in disarray.