Latest from IPE Magazine – Page 143

-

Features

UK pools slam ‘simplistic’ guidance

UK local authority funds have accused the government of imposing higher costs through changes in its stance towards asset pooling.

-

Country Report

General pension funds: A market stirred but not shaken

General pension funds nearly doubled their AUM last year, to €10bn. However, one of the six commercial players has already closed and another will probably leave the market

-

Special Report

Legal Framework: The lay of the law

A new project aims to find answers to some fundamental legal questions about investing, people and planet

-

Features

Handelsblatt Conference: De-risking comes to the fore as past costs loom large

German pension schemes reveal ambitious overhauls to reduce sponsor burdens; Generali moves to reassure over sale of insurance business to Viridium

-

Special Report

Special ReportAlignment: mind the gap

What role might market participants play to plug the SDG gap?

-

Special Report

Fiduciary Duty: Making the right impact

Impact funds range from those that seek to generate attractive returns while pursuing social objectives to those that focus solely on the social aims

-

Features

FeaturesMadan Pillutla: Debiasing needs more attention

Madan Pillutla, professor of organisational behaviour at the London Business School, outlines the reasons why biases are so hard to overcome

-

Features

FeaturesAccounting Matters: Splitting the difference

If ever proof were needed that the dividing line between defined benefit (DB) and defined contributions (DC) pension promises is coming under pressure, it was a discussion at the IFRS Interpretations Committee (IFRS IC) on 6 March.

-

Opinion Pieces

Opinion PiecesDon’t panic (yet) about populism

When I called for investor engagement with Facebook and the social media giants, I did not expect to see a sovereign wealth fund leading such an initiative just three months later

-

Interviews

On the Record: The volatility question

We asked two European pension funds how they view, and invest in, the hedge fund sector at a time when volatility is structurally low

-

Interviews

InterviewsHow we run our money: Railpen

Andrea Ash (pictured), investment director at RPMI Railpen, tells Carlo Svaluto Moreolo about the UK pension fund’s private markets strategy

-

Features

FeaturesForeign pension funds set for tax refunds on UK property income

A recent ruling by the UK Tax Tribunal decided that the imposition of UK income tax on the property income of a German pension scheme was unlawful under EU law

-

Features

PEPP: no straightforward route

Some entities will not be eligible to offer PEPP products in Bulgaria, which looks like a recipe for market confusion

-

Features

FeaturesBecoming a mortgage lender

More pension funds are eyeing residential mortgages as an asset class

-

-

Interviews

Strategically speaking: Research Affiliates

Self-described lifelong quant Rob Arnott finds the quantitative-investing industry often guilty of “overhyping and overselling” ideas

-

Features

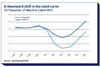

FeaturesFixed Income: Markets take nervous turn

Almost every asset class did well in the first quarter of 2019

-

Special Report

Asset Allocation: The future looks synthetic

A decade ago, synthetic ETFs were the pariahs of the asset management industry. Now, though, the tides are turning – with some sectors experiencing a revival in synthetic flows