Latest from IPE Magazine – Page 145

-

Features

FeaturesDeviate at your own risk

The recent controversy about factor investing has probably not caused any distress to the investment industry, let alone the wider public, but it is a fundamental one

-

Country Report

Country ReportPensionsfonds flourish

Several trends have converged to bolster the popularity of Pensionsfonds

-

Special Report

Special ReportWays to improve DC pensions

International policy best practice holds lessons for UK defined contribution pensions

-

Special Report

Special ReportStrategy: Factor rotation hits record pace

Tilting between factors could work well in this environment

-

Asset Class Reports

Asset Class ReportsBrexit: Deal or no deal

Brexit uncertainties are making stockpicking a difficult task

-

Features

FeaturesWhat’s in a number?

There has been much hand wringing among UK actuaries and pension scheme managers about the impact of a recent court ruling requiring certain pension benefits to be paid equally to men and women

-

Country Report

Country ReportPension risk management

Portfolios are facing up to the challenges of the economic environment. But there is still room to improve expected returns

-

Special Report

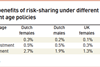

Special ReportManaging macro-longevity risk

An internal market for macro-longevity risk could provide an alternative to hedging tools

-

Special Report

Special ReportMulti-factor ETFs: A recipe only as good as its ingredients

The performance of multi-factor ETF strategies reflect the choice of factors as well as portfolio construction

-

Country Report

Country ReportVBV: Exciting possibilities

Günther Schiendl, CIO of VBV, Austria’s largest pension fund, talks to Barbara Ottawa about the importance of illiquidity and the EU’s sustainable finance initiative

-

Special Report

Special ReportApplying rocket science to EMs

Factor investing strategies are increasingly being used in emerging market investing

-

Special Report

Special ReportInvestment Research: MiFIDII – a year of adjustments

Firms are under competitive pressures as the market for investment research takes shape

-

Special Report

Special ReportTaxation: How to soften the tax bite

Research shows tax management can boost returns from factor investment

-

Features

FeaturesPLSA Conference: On the brink of cost transparency

Trustees, consultants and other pension professionals gathered in Edinburgh in early March for the annual investment conference of the Pensions and Lifetime Savings Association (PLSA).

-

Features

FeaturesAccounting matters: Limiting the scope

The IASB is looking at IAS 19. Will the project run into the sand?

-

Interviews

InterviewsHow we run our money: APK Pensionskasse

Christian Böhm, CEO of Austria’s APK Pensionskasse, talks about the organisation’s blend of dynamic and long-term investment strategy

-

Features

FeaturesESG: Code could boost engagement

Loopholes in the revised Stewardship Code under consultation in the UK may mean it fails to realise its full potential for raising engagement with investee companies.

-

Interviews

InterviewsCheyne Capital Management: High-impact debt investor

The growth of non-bank lending in Europe is often mentioned as a trend that could radically transform the European economy. This remains to be seen, but if banks gradually give some of their dominance in the lending market, then firms such as Cheyne Capital Management stand to benefit.