Latest from IPE Magazine – Page 149

-

Special Report

Special ReportWhy FRR doesn’t invest in green bonds – for now

While the French pension reserve fund has embraced and integrated the sustainability agenda in its investment strategies and was one of the first to incorporate climate change into its portfolio, it does not invest in green bonds

-

Features

FeaturesBeyond green bonds

Green finance is booming. Interest in green finance is booming even more.

-

Country Report

Country ReportDB funding: Calm waters or the eye of the storm?

An update on the accounting deficits in Irish defined benefit (DB) pension schemes

-

Special Report

Special ReportAsset managers: New fee models

The growing passive investing trend is forcing investment managers to offer new fee structures

-

Asset Class Reports

Asset Class ReportsVenture capital: Venturing further in Europe

The European venture capital market is increasingly attractive

-

Special Report

Special ReportAlecta: a Swedish investor’s green bond learning curve

Alecta, the largest occupational pension provider in Sweden, with SEK874bn (€85.4bn) in assets, now invests SEK31.4bn in green bonds.

-

Features

FeaturesRegulatory capacity crunch?

This year could turn out to be a lucrative one for lawyers in the pension and investment sectors. Deciphering Brexit implications, ensuring compliance with IORP II and localised rulebook changes will keep the legal profession busy

-

Special Report

Special ReportAsset managers: The profitability time bomb

How are asset managers responding to an environment with rising costs and fee pressures?

-

Special Report

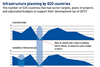

Special ReportInfrastructure: Joining the dots on green projects

Lack of a co-ordinated policy is hindering climate-friendly infrastructure investment

-

Special Report

Special ReportOcean finance: In search of blue returns

Attention on polluted seas is leading to discussions about how to marshal capital to clean them up

-

Special Report

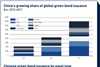

Special ReportChina: The greening of China

China plans to invest more than $6trn in green power and clean tech in the next two decades

-

Opinion Pieces

Leading viewpoint: 2019's green investment picture

Lack of standards is not hindering green bond issuance. Pressure on corporates to finance the energy transition will intensify

-

Special Report

Green bond funds: Mixed climate for European funds

Assets are up, but performance is down

-

Interviews

On the record: Asset management fees

We asked two European pension funds about their attitude to asset management fees and costs

-

Features

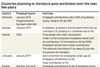

FeaturesAuto-enrolment grows globally

A growing number of countries are planning to reduce the strain placed on public finances of providing pensions to ever more retirees by encouraging individuals to make more adequate provision for their own retirement

-

Features

FeaturesUS economy: Overpricing recession risk

Financial markets have suffered a nasty bout of indigestion since October. The interplay of sentiment and volatility induced widespread pessimism, with added concern that market tantrums could subsequently bleed into the real economy

-

Features

FeaturesCLO supply outstrips demand

Do reports of a growing wariness over collateralised loan obligations (CLOs) mean that the good times are over for the investment vehicle?

-

Interviews

InterviewsStrategically speaking: Sumitomo Mitsui Trust Asset Management

Following the group’s reorganisation, SMTAM’s David Semaya outlines ambitious plans to widen their international expansion

-

Features

FeaturesFixed income, rates, currencies: Clouds to darken further

Markets have pulled back from US rate hike forecasts; Euro credit looks set to be most vulnerable to quantative tightening; The European elections in May look set to see a surge in support for populist parties

-

Features

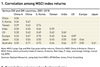

FeaturesAhead of the curve: Hold faith in Chinese equities

Exposure to Chinese equities presents opportunities in both market beta and alpha