Latest from IPE Magazine – Page 150

-

Features

FeaturesIPE Expectation Indicator: February 2019

The end of 2018 saw expectations shift meaningfully in certain markets, and then pause. It also saw trends accelerate, then pause. For most of us, the pauses were welcome, because the shifts were related to broad market plans

-

Interviews

InterviewsHow we run our money: Laborfonds

Ivonne Forno (pictured), the CEO of Laborfonds, the Trentino-Alto Adige/Südtirol regional pension fund, talks to Carlo Svaluto Moreolo shortly after the fund’s 20th birthday

-

Opinion Pieces

Opinion PiecesGuest viewpoint: Lisa Brüggen & Thomas Post

”Pension funds, insurance companies and policymakers should limit choices to 6-22 option”

-

Opinion Pieces

Opinion PiecesBanking on life after politics

At 49, Brian Hayes is young man by political standards. Having started in Irish politics early with his appointment to the Irish Senate in the mid 1990s, Hayes was elected to the Dáil, the lower house, before he was 30, taking a seat for the Fine Gail party.

-

Opinion Pieces

Opinion PiecesIs BlackRock set to revive annuities?

What can happen if the largest global asset manager teams up with the largest software company, which also happen to be the first and second largest companies in the world by market cap?

-

Features

IORP II kick-starts consolidation

In the final article on a new survey, Pascal Blanque and Amin Rajan argue that IORP II is set to drive out structural inefficiencies in the EU pension landscape

-

Features

FeaturesA glimpse into the future

For many people, being asked to solve their retirement planning problems is akin to being asked to build their own car

-

Country Report

Country ReportPoland: A policy gear change

Auto-enrolment to be rolled out in Poland as the second pillar is wound up

-

Special Report

Netherlands: A new Dutch blueprint

Several pension experts contend Shell’s individual DC plan could provide a good model for the wider Dutch market

-

Features

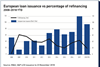

FeaturesBriefing: Collateral challenges

Rising interest rates put collateral management strategies to the test

-

Special Report

Special ReportInvestor perspectives: Playing the long game

At an uncertain time for equity markets, European investors discuss their strategies

-

Asset Class Reports

High yield: Coping with a new environment

This year high-yield investors will have to weather not only the winding up of quantitative easing but additional political challenges

-

Features

FeaturesDouble standards on trade

No wonder the discussion of trade is in such a tangle. The terminology around the subject is almost designed to cause confusion.

-

Country Report

Romania: Weighing the second pillar

Romania must weigh short-term budgetary constraints against long-term capital market development as it considers its second-pillar pension system

-

Special Report

UK: Learning from the lab rat

The UK has got many things right when it comes to auto-enrolment. What should other countries learn from the policy?

-

Features

FeaturesBriefing: Trade war, a primer

Protectionism is becoming more widespread despite the benefits of free trade being understood for more than two centuries

-

Special Report

Special ReportEquity risk premium: The X factor

Although central to financial theory, the equity risk premium is hard to apply in practice

-

Asset Class Reports

Asset Class ReportsLeveraged loans: Applying leverage

Leveraged loans have performed well recently but regulators are expressing concerns about risks