Latest from IPE Magazine – Page 151

-

Features

FeaturesInvesting is not a zero-sum game

The rampant bull market of the past decade could already be a thing of the past and institutional investors are understandably nervous about the future

-

Country Report

Bulgaria: Can investors rely on pensions?

Bulgarian pension savers receive paltry returns after inflation and costs

-

Special Report

US states move to fill pensions gap

States in the US are offering retirement savings plans to workers who are not covered by company-sponsored schemes

-

Features

FeaturesBriefing: MiFID II: a year on

The new rules are having a dramatic effect on the world of investment research

-

Special Report

Special ReportDiversification: Shelter from the storms

The benefits of diversification are not as clear-cut as investors often assume

-

Asset Class Reports

Banking debt: The paradox of bank debt

The peculiarity of bank debt is that it can be issued by institutions with strong balance sheets

-

Features

FeaturesHow far should auto-enrolment go?

Some are contemplating whether auto-enrolment into pension funds could be expanded to help savers in other areas of their financial lives

-

Country Report

Country ReportCapital markets: Power to the centre

There is a trend among regional capital market participants for the increased centralisation of regulation, but it needs to be counterbalanced by increased trust

-

Special Report

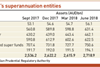

Special ReportAustralia: Changing fortunes

A new landscape for Australia’s fast-growing super sector will evolve over the next five years

-

Special Report

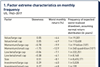

Special ReportThe ignored risks of factor investing

Factor investing is not immune to prolonged periods of underperformance

-

Country Report

Country ReportSecond-pillar pensions in Central & Eastern Europe

Analysis of assets, membership and asset allocation

-

Opinion Pieces

Opinion PiecesLong Term Matters: What do Facebook’s investors care?

Mark Zuckerberg “is a bigger threat to American democracy than Donald Trump”, says David Runciman, professor of politics at Cambridge University

-

Features

Accounting Matters: Full agenda for 2019

German DB plan sponsors might be busily acquainting themselves with new longevity tables, while in the UK there is really only one question on some accountants’ minds – GMP equalisation

-

Features

FeaturesExit Interview: Peter Hansson

Peter Hansson, former CEO of Sparinstitutens Pensionskassa, decided to retire after 25 years with the pension fund for savings institutions in Sweden as new regulatory changes loom

-

Features

FeaturesResearch - Europe: Investors braced for an era of lower returns and higher volatility

In the second of three articles on a new survey, Pascal Blanque and Amin Rajan argue that pension investors are adapting to challenges that go beyond the realms of a maturing business cycle

-

Interviews

On the Record: Adapting to change

As the equity markets begin 2019 in worse shape than last year, we asked three European pension funds how they conceive and execute their equity strategy, in order protect the portfolio

-

Interviews

InterviewsHow we run our money: PWRI

Xander den Uyl, chairman of PWRI, the Dutch fund for disabled workers, tells Carlo Svaluto Moreolo about its particular approach to ESG

-

Features

FeaturesESG: France’s Article 173: taking stock

France’s ground-breaking reporting duty for institutional investors is being reassessed after a two-year test period

-

Features

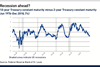

FeaturesFixed income, rates, currencies: Hope but also fears for 2019

US domestic investors hold healthy stock market profits after a decade-long bull run Geopolitics on many fronts point to tumultuous times ahead

-

Features

FeaturesAhead of the curve: MiFID II increases asset risk

Attempts to improve transparency of research costs have unintentionally hit performance