Latest from IPE Magazine – Page 154

-

Features

ESG: Scheme to develop green mortgages

Lenders see an apparent correlation between energy efficiency and lower defaults

-

Interviews

Strategically speaking: BlackRock Credit

BlackRock is adding to its global private debt capabilities

-

Features

Fixed income, rates, currencies: Challenges still lie ahead

While the US mid-term elections saw the Democrats regain the House of Representatives, trade policy remains in the hands of the White House. Trade tensions, between the US and China in particular, will remain to the fore. President Trump’s aggressive trade policy is already having a global impact with declining purchasing manager indices indicating corporate hesitation in future plans.

-

Features

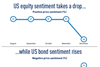

FeaturesIPE Expectations Indicator: December 2018

At times we aim to find the mountains within the molehills of manager expectation shifts. In our defence, any curvature is worthy of recognition. Sometimes, changes (or lack thereof) come along that are worth diving into. In the prior survey, it was the four-month lack of change within the high sentiment toward US equity markets to rise that was significant. During the current period, hyperbole aside, change has come.

-

Interviews

InterviewsHow we run our money: Första AP-fonden (AP1)

Mikael Angberg, CIO of Första AP-fonden (AP1), one of Sweden’s buffer funds, outlines the fund’s investment philosophy to Carlo Svaluto Moreolo

-

Features

How do investors view the future of the EU economy?

Cyclical recovery or secular healing? That is the big question behind the European Union’s economic bounce after its ‘lost decade’ – the toughest period since the founding of its predecessor, the European Economic Community, in 1957.

-

Features

Accounting Matters: The audit F-word

Increased incidence of accounting fraud raises questions about UK audit standards

-

Opinion Pieces

Letter from the US: REITS a good long-term bet, says study

Investors have lost some of their enthusiasm for US REITs – real-estate investment trusts – after their poor performance in the third quarter. From July to September, the FTSE Nareit All Equity REITs index gained 0.5%, compared with a 7.6% return for S&P 500 over the same period. The return of the REITs index has trailed behind S&P 500 by more than seven percentage points for the first three quarters of the year.

-

Opinion Pieces

Opinion PiecesBrussels People: Sven Giegold, MEP

While he derives some satisfaction from advances in green energy and the like, Sven Giegold is unhappy that most global investment can still be classed as environmentally unsustainable.

-

Features

Ahead of the curve: Sporting a safety jacket in a market of weak protections

Funds that take on loans that have been rejected by banks are likely to be problematic for investors

-

Opinion Pieces

Opinion PiecesGuest viewpoint: Simon Lewis, AFME

Europe’s capital markets are facing some of their toughest challenges since the global financial crisis

-

Country Report

Country ReportNordic Region: Shifting borders

Is the Nordic dream of a unified Danish-Swedish pensions market over?

-

Features

FeaturesMarket approaches nudged off course

Sweden’s experience with the Premium Pension system shows how arduous dismantling of poorly constructed architectures can be

-

Special Report

Special ReportSpecial Report: ESG takes root

One in every four professionally managed dollars is now invested sustainably according to some definition, with a total of $22.9trn run in this way overall

-

Asset Class Reports

Emerging Market Debt: Sentiments drown out sense

The political and economic uncertainty surrounding Turkey and Argentina is distracting investors from the sound fundamentals to be found elsewhere across the asset class

-

Special Report

Credit: Reading the cycle

The complex prevailing economic and political environment makes it difficult to predict how long the current credit cycle will continue

-

Country Report

Country ReportAsset Allocation: Innovation for the future

Nordic institutions maintain an innovative diversification path

-

Special Report

Asset Allocation: Bumpy roads ahead

Investors see the outlook for the asset class as positive in the medium term but riskier in the short term

-

Features

FeaturesSlowing longevity may be a dip

Demographic trends tend to be outcomes rather than causes of broader social shifts

-

Special Report

Do asset managers have what it takes?

Integration is high on the agenda for most asset managers. What does it take to build truly sustainable portfolios?