Latest from IPE Magazine – Page 159

-

Features

Chinese Bonds: Too big to ignore?

Recent tax reforms and the expected inclusion in global indices of Chinese sovereign bonds has shone a spotlight on a vast, under-exploited, multi-trillion bond market

-

Opinion Pieces

Opinion PiecesGuest Viewpoint: Jim Hawley and Jon Lukomnik

It is fitting that we launched our ‘Purpose of Asset Management’ paper in London, not far from 221b Baker Street, the home of the famous fictional detective, Sherlock Holmes.

-

Opinion Pieces

Opinion PiecesLetter from Brussels: Focus on pension products and supervision ahead of elections

Tensions are rising in Brussels as the EU institutional mandate approaches its end ahead of the Parliamentary elections in May 2019, and the Commission has already ceased issuing new proposals in the absence of legislative time.

-

Special Report

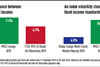

Special ReportImplementation: A cost comparison of futures and ETFs

The investment management industry has seen a relentless drive to wring out costs. A good grasp of implementation cost of using different vehicles for the same strategy matters

-

Special Report

Special ReportFixed income: The growing world of fixed income ETFs

The fixed income ETFs market has experienced rapid growth in recent years as more investors are now finding a role for them in their portfolios

-

Special Report

Special ReportFixed income: Consistent growth in a changing landscape

Fixed income, an asset class that historically traded over the counter, is increasingly being traded on exchange through exchange-traded funds (ETFs)

-

Special Report

ESG: Building impact and values into portfolios

Exchange-traded funds that prioritise environmental, social and governance matters have grown exponentially in popularity over the past few years

-

Special Report

ESG: Managing indices to match convictions

More and more investors know it is perfectly possible to link index management with responsible investment by choosing an index fund or an ETF

-

Special Report

ESG: Responsible investing that reduces your carbon footprint

The development of ESG indices reflects growing interest in divesting out of fossil fuel investments to address the threat posed by global warming

-

Special Report

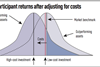

Special ReportFactor investing & smart beta: What’s in a name?

Many smart beta ETFs are bought with the expectation of long-term market outperformance. The factors that many are based on have been proven both academically and empirically to produce excess returns

-

Special Report

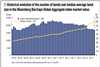

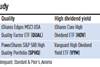

Factor investing & smart beta: Advances in factor-based fixed income indices

Global fixed income investors have benefited from a long bull market that began in the early 1990s

-

Special Report

Special ReportFactor investing & smart beta: The smart beta (r)evolution

The ability of stocks with certain investment characteristics to outperform the market has been well understood and documented for decades. But options of how to implement this strategy were limited

-

Special Report

Markets & regions: Spotlight on US equities

US equities have proven overwhelmingly popular with investors desperate for signs of economic growth

-

Special Report

Markets & regions: Using ETFs to position for a US–China trade war

Many media and market commentators believe that the potential US-China trade war could be one of the largest risks facing the global economy

-

Special Report

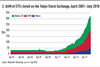

Special ReportMarkets & regions: The dynamic market in Japanese equity ETFs

Opinions of Japan as a market tend to be quite polarised and the country has looked cheap on a valuation basis for quite some time, both historically and relatively

-

Special Report

Markets & regions: How commodities strategies can help investors diversify their portfolios

In the current market environment, investors are looking for asset classes that can lower overall portfolio volatility without sacrificing returns

-

Special Report

Special ReportNew frontiers: Getting to grips with cryptocurrencies

For institutional investors and asset managers, crypto-currencies pose a triple dilemma

-

Special Report

New frontiers: Esoteric ETFs – egregious or genius?

From companies capitalising on cannabis decriminalisation to the streaming of Quincy Jones’s music, you can almost guarantee there is an ETF available to enable you to invest in it

-

Special Report

Regulation: Spotlight on liquidity, transparency and viability

ETFs may represent a tiny speck on the overall investment landscape but they are one of the fastest-growing products in the investment industry

-

Features

FeaturesHolistic answers needed

Fiduciary management was conceived as a sophisticated and holistic solution to the shortcomings of pension asset management that became evident after the equity market downturn of 2000-03