Latest from IPE Magazine – Page 17

-

Opinion Pieces

Opinion PiecesGerman pension reforms in limbo after coalition government collapse

The collapse of Germany’s three-way ‘traffic light’ coalition in November opens questions about the fate of the pension reforms it had drafted over the past couple of years. The government, led by Olaf Scholz, started in 2021 with a mission to reinforce the capital-funded component of the pension system.

-

Opinion Pieces

Opinion PiecesBig Swedish providers raise pension switch worries

Pension transfers are big business in Sweden, and the market could be described as booming right now.

-

Opinion Pieces

Opinion PiecesAustralians seek €3.1bn in lost superannuation contributions

In 2021-22, one in four Australian workers missed out on their superannuation contributions. The total lost was A$5.1bn (€3.1bn), despite the country having a compulsory superannuation system.

-

Opinion Pieces

Opinion PiecesFuture of ESG investing in doubt following decisive Trump victory

In the past two years, an anti-ESG backlash has grown strong roots on the American right.

-

Opinion Pieces

Opinion PiecesEurope must prepare for a China after Xi Jinping

Whatever the big issues of the 21st century, whether climate change, the environment, restoring economies post-COVID, fighting poverty or ending the war in Ukraine, they are much easier to resolve if countries work together.

-

Features

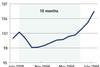

FeaturesInsurance-linked securities bank a stellar year for returns

Insurance-linked securities (ILS) may be complicated, but they are gaining an institutional following especially among pension and sovereign wealth funds, multi-asset investment firms and endowments.

-

Country Report

Country ReportSwitzerland country report 2024: The trouble with Swiss second-pillar pension reform

Attempts to reform occupational pensions continue to fail, risking undermining public trust. But pension funds have already been making their own pragmatic changes

-

Country Report

Country ReportSpanish country report 2024: Pension funds eye a new rate environment

Buoyed by strong returns, pension funds have been lengthening the duration in their fixed-income portfolios

-

Special Report

Special ReportESG: Investors embrace new challenges on 1.5°C climate goal

The world has changed considerably since we first started publishing this annual special report in 2018, not least in that the rise of greenwashing concerns is leading to a phasing-out of terms such as ESG.

-

Asset Class Reports

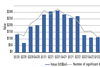

Asset Class ReportsPrivate equity industry starts to show signs of recovery

Private equity has a bounce in its step once again, but it could be years before the industry recovers fully

-

Country Report

Country ReportIs Switzerland’s pension system facing a crisis following referendum on reform defeat?

In a referendum in September, Swiss voters rejected proposals to reform the supplementary pension system, known as BVG in German.

-

Special Report

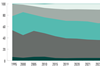

Special ReportPension funds outline progress towards net zero

Europe’s leading pension funds talk about their journey to net zero so far

-

Asset Class Reports

Asset Class ReportsValuations for AI-related firms are starting to heat up

There are concerns that the market for acquiring artificial intelligence-related companies is showing signs of overheating

-

Country Report

Country ReportLower interest rates see Swiss pension funds adjust asset allocations

Lower rates are nudging Swiss pension funds to rethink their approach to fixed income and private markets

-

Asset Class Reports

Asset Class ReportsInvestor body aims to fill reporting gap

ILPA issues reporting guidance and templates after US court overturns SEC’s private funds rule

-

Special Report

Special ReportInvestors raise their voice in responsible investment policy debate

Investors once shied away from the murky business of lobbying but now they are changing their tune

-

Special Report

Special ReportInvestors await influx of standardised corporate sustainability data

New EU corporate sustainability reporting standards will drive disclosures on hundreds of datapoints by thousands of companies.

-

Country Report

Country ReportTransition strategy one step at a time

Pension funds and asset managers are upping their game when it comes to the transition to a low-carbon economy

-

Special Report

Special ReportNew ways of looking at corporate carbon mitigation activities

A new label could help investors identify companies that take a holistic approach to carbon reduction

-

Special Report

Special ReportCan banks move the dial on carbon emissions?

Despite their high-profile commitments, the banking sector’s progress on reducing lending to high emitters is far from clear