Latest from IPE Magazine – Page 185

-

Features

Briefing: Proper plan design is way forward

International pension plans involve complex questions of structuring and compliance

-

Interviews

InterviewsHow we run our money: Joachim Schwind & Andreas Hilka

Joachim Schwind and Andreas Hilka, veterans of the German pension industry, tell Carlo Svaluto Moreolo how the country’s pension reform will change pension fund management

-

Features

Private Equity: Buying in a seller’s market

Private equity has outperformed the public markets for the past five years and institutional investors have been ramping up allocations

-

Features

China’s MSCI inclusion widens the assets horizon

The addition of China A-shares to the MSCI Emerging Market index is symbolically important for China and could lead to improvements in regulation and corporate governance

-

Features

ESG: Hearing the voices of employees

The UK government hopes that strengthening the voice of employees in corporate governance arrangements will help restore public trust in business

-

Interviews

Strategically speaking: Robeco

Only a few weeks after the 1929 Wall Street crash, a group of seven Rotterdam businessmen set up the Rotterdamsch Beleggings Consortium, later shortened to Robeco

-

Features

Asset Allocation: Economic growth holds steady

After a quieter summer for capital markets than in previous years, relieved risk assets remain popular. Economic growth has maintained a healthy pace with inflation yet to seriously surprise to the upside

-

Features

Ahead of the Curve: The rise of the cloud corporates

Digitalisation has profound implications for how corporates do business. It affects the way goods or services are invented, produced, marketed and consumed

-

Features

FeaturesIPE Expectations Indicator October 2017

Despite rising geopolitical tensions, there was no corresponding rise in negative sentiment in the most recent survey period. That does not mean there were no changes in sentiment trends; only that shifts were mostly slight

-

Opinion Pieces

Opinion PiecesGuest Viewpoint: Robin Ellison

“The FCA has picked the wrong fight. We need a way to rate alternative investments”

-

Opinion Pieces

Letter From Brussels: Pension rights for posted workers

Discussions over the payment of social costs for workers from central and eastern European countries posted temporarily to wealthier EU countries are playing a major role in the attempt to update existing directives

-

Opinion Pieces

Opinion PiecesLetter from the US: Tide turning against divestment

Will the movement in favour of divesting from fossil fuels slow down among US pension funds?

-

Features

Portfolio Construction: Themes for defensive investing

Global uncertainties and disruptions call for more care when building a defensive portfolio

-

Country Report

Country ReportUK pensions: Running the rule on costs

A large proportion of institutional investors’ costs remains opaque. Will a new UK initiative change this?

-

Country Report

Country ReportDutch pensions: Aiming for full transparency on costs

Dutch funds are now required to provide deeper insight into their expenses in their annual reports

-

Special Report

Investment Solutions: No turning back

The way UK pension schemes receive investment advice could change following an investigation by the financial regulator

-

Special Report

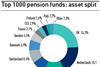

Special ReportTop 1000: A bird’s eye view of €7trn

The assets captured in IPE’s annual study of the leading European retirement asset pools total €7.04trn, up from €6.74 last year – an increase of 4.45%. Yet this growth in assets masks a varied picture

-

Asset Class Reports

EM debt: China evokes unjustified fears

Many foreign investors fail to grasp the transformation of China’s bond markets

-

Features

Debt warning signs are hard to read

A World Bank study highlights increasing levels of debt in emerging markets