Latest from IPE Magazine – Page 197

-

Special Report

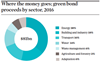

Special ReportGreen growth

High levels of green bond issuance have sparked investor interest and spawned funds and strategies, writes Rachel Fixsen

-

Special Report

Beware of taking labels at face value

Sebastian Ceria and Melissa Brown warn that exchange-traded funds with similar labels can generate widely different returns because of the way their portfolios are constructed

-

Special Report

All investment impacts

Institutional investors looking at impact strategies should take a holistic view of their portfolio, argues Jane Ambachtsheer

-

Special Report

Case Studies: LPP and FRR

Charlotte Moore outlines how two pension funds are using factor-investing strategies

-

Special Report

Interview: Amit Bouri - GIIN

Susanna Rust asks Amit Bouri, CEO of the Global Impact Investing Network, about the opportunities and risks that come with impact investing’s growing popularity

-

Special Report

Top-down versus bottom-up multi-factor approaches

Noël Amenc, Frédéric Ducoulombier, Felix Goltz and Sivagaminathan Sivasubramanian look at the pros and cons of top-down and bottom-up strategies for factor investing

-

Features

German pensions: A new not-quite revolution

The current reforms risk repeating some of the mistakes of the Riester plan. Devolving responsibility to social partners for creating new sector schemes risks passing the buck

-

Country Report

Pensions In Austria: Funds take real risk

Real assets such as infrastructure are on the radar for Austrian institutional investors, finds Barbara Ottawa

-

Country Report

Country ReportPensions In Germany: Draft law under discussion

Germany’s discussion on new pension vehicles without guarantees has revealed a much deeper challenge with promises, disappointments and misunderstandings, finds Barbara Ottawa

-

Special Report

Special ReportIPE at 20: Back to 1996 - four moments in pension investing

Fads and fashions ebb and flow, in the world of pension investment seemingly as much as any other. Balanced management is firmly out of favour. Fiduciary management is in. Yet both represent a different take on the outsourcing of investment

-

Special Report

Special Report Consultants: A testing time

The UK’s Financial Conduct Authority is assessing whether a lack of competition among pension consultants is hurting UK pension schemes

-

Asset Class Reports

Asset Class ReportsInvesting In European Equities: Worrying times

Political uncertainty in Europe poses dangers and offers opportunities. Joseph Mariathasan investigates

-

Features

Europe: The genie is out of the lamp

Times have changed since the Society for the German Language chose Alternativlos (without alternative) as its Unwort (literally ‘unword’ or ugliest word) of the year for 2010

-

Country Report

Pensions debate in camera

Germany is preoccupied with debates on pensions, while in Austria the issue is discussed behind closed doors, according to Barbara Ottawa

-

Country Report

Aba: DC and auto-enrolment, German style

Verena Menne and Klaus Stiefermann outline concerns about planned reforms to introduce defined contribution pensions to Germany

-

Special Report

IPE at 20: Time for retirement ‘SeLFIES’?

The potential global retirement crisis needs to be addressed by timely innovation. The longer governments wait, the higher the cost, argue Robert Merton and Arun Muralidhar

-

Special Report

Consultants: Changing roles

IPE asked pension consultants across Europe and beyond how they are responding to changes in the wider pension sector. Here is a selection of their views

-

Asset Class Reports

Asset Allocation: Defining Europe for investors

Investors looking to invest in European equities have to decide on what countries to include as well as exclude, as their choices could have significant impacts on portfolio performance, finds Joseph Mariathasan

-

Features

Fiduciary managers need more competition

The review of the UK’s asset management market by the FCA may or may not result in tighter regulation of investment advice. But the regulator would do well to continue focusing on investment consulting firms that offer fiduciary management services

-

Country Report

A long-awaited reform: Allianz Global Investors

The reform to introduce pure defined contribution plans is a huge opportunity. But if it does not succeed it may mark the beginning of mandatory corporate pensions