Latest from IPE Magazine – Page 252

-

Interviews

Strategically speaking: Oaktree Capital Management

Howard Marks is the co-founder and co-chairman of Oaktree Capital Management, known in the investment community for memos to clients which detail distressed debt, credit and other investment strategies, insights into the economy, as well as for his distinctive investment philosophy

-

Features

QE: Uncertainty is Queen

It is unsurprising that Dutch pension funds sought to voice their concerns about the effect of QE on their sector before that decision was ratified

-

Country Report

Country ReportSwitzerland: Pensionskassen keep calm under negative rate storm

Switzerland has not seen negative rates since the 1970s, years before the creation of the current BVG second-pillar system

-

Asset Class Reports

Asset Class ReportsEuro-zone sovereign bonds: A parallel world

Regulation continues to push European pension funds to invest in euro-zone government debt at increasingly unattractive yields

-

Special Report

Two cheers for the euro-zone

January’s announcement by the ECB of its bond purchase programme has been followed by good numbers

-

Special Report

Special ReportTop 400 Asset Managers 2015: Global assets top €50trn

Once again, IPE surveyed over 400 managers for this year’s study, canvassing end-2014 data in most cases. The results give a broad overview of the global asset management sector, with granular depth on European managers and institutional business

-

Country Report

Altersvorsorge 2020: An ageing reform package

Switzerland’s system of direct democracy is complicating the debate about pensions reform

-

Asset Class Reports

Grexit and euro-zone ratings

Greece’s exit from the EU could cause other countries to follow, and ultimately lead to the destruction of monetary union

-

Special Report

Special ReportEuro-zone recovery: Catching a tailwind

Euro-zone assets have generally performed well in recent years, but there are some substantial hurdles if their growth is to be sustained

-

Special Report

Top 400: Investing for the future

Changing institutional investor thinking has profound implications for asset managers. Here, eight leading figures from six international organisations outline progress made on an initiative to realign institutional investment with long-term goals

-

Special Report

Top 400: Disruptive change - an end to the innovator’s dilemma?

The combination of technology and innovation like exchange-traded funds looks set to change some aspects of the asset management value chain, according to Amin Rajan and Subhas Sen

-

Country Report

Talking Heads: Ask the experts

Swiss Investors are grappling with negative bond yields and interests rates on cash deposits. We asked experts to assess the situation and share their thoughts for the future of the second-pillar

-

Special Report

The unique case of Greece

The tribulations of recent years have turned Greece into a unique case within the euro-zone

-

Asset Class Reports

Euro-zone sovereign bonds: State of the nations

QE helps but only reform can resolve the euro-zone’s problems, according to David Zahn

-

Special Report

Top 400: A better deal on fees

Fee structures are imperfect and may be poor value. Nick Sykes outlines ways they could be improved for institutional investors and investment managers

-

Country Report

Q&A with Karin Oertli, head of UBS Global Asset Management Switzerland

The Swiss financial industry is changing, with providers facing stricter regulation, increased international competition and a heightened cost awareness by clients

-

Special Report

Special ReportELTIFs: Kick-starting Europe's economic growth

European Long-Term Investment Funds are designed to help kick-start economic growth by broadening the range of investors in infrastructure and research projects

-

Special Report

Top 400: Managing talent in a new world

Tim Wright says agility and innovation will be crucial to attracting and retaining key personnel in the asset management industry

-

Special Report

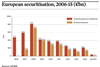

Special ReportRegulatory environment still weighted against Europe's ABS market

The European market for asset-backed securities has ample potential but suffers as a result of an unfavourable regulatory regime

-

Country Report

Asset Management Costs: Effects of transparency

The requirement to publish total expense ratios in the annual reports of Swiss Pensionskassen is changing the market