Latest from IPE Magazine – Page 270

-

Interviews

Strategically speaking: Grandmaster Capital Management

“Under no circumstances should you play fast if you have a winning position,” advised Hungarian chess Grandmaster Pal Benko. “Use all your time and make good moves.”

-

Asset Class Reports

Investing In Hedge Funds: About turn for top-down

Macro, the darling of the hedge fund world through the drama of 2008-09, has struggled in the subsequent low-volatility, low-rates environment. Joseph Mariathasan asks whether recent outperformance signals a more conducive backdrop for this family of strategies

-

Asset Class Reports

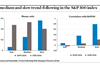

Asset Class ReportsInvesting in Hedge Funds: Is the trend your friend?

Alex Greyserman looks at how trend-following at different speeds has fared in equity markets during the post-crisis bull market and over the longer term, and finds compelling diversification benefits

-

Asset Class Reports

Investing in Hedge Funds: Uncut hedges

US pension giant CalPERS may have stopped investing in hedge funds, but despite heightened short-term scrutiny, Christopher O’Dea finds that most plans are retaining their allocations, and expecting them to deliver greater value through bespoke strategies

-

Features

Asset Allocation Fixed Income, Rates, Currencies: The big picture

When the Fed embarked upon its first round of quantitative easing five years ago, there were fears of an inflation time bomb. The Fed has already purchased its last lot of Treasuries under QE3, but is still executing regular MBS purchases, as forward inflation expectations in the US and Europe are as low as they have been for years.

-

Features

Ahead of the Curve: Europe is the new China

George Saravelos sees ‘euroglut’ – and consequently one of the biggest capital outflows in history as excess savings flee aggressive ECB easing, sending the euro plunging against the dollar.

-

Features

FeaturesFrom Our Perspective: Ready for action

Industry figures like Roger Urwin of Towers Watson have long advocated that pension funds should use their fee budget effectively according to their size and scale, perhaps foregoing costly alternative strategies in favour of recruiting in-house staff.

-

Opinion Pieces

Research: Ageing demographics are an asset allocation game changer

Two of the four worst bear markets of the last century rocked the world of investing over just seven years in the last decade. They sidelined conventional wisdom on risk premia and diversification.

-

Features

FeaturesSpecial Report – Outlook 2015: Fear gauges refuse to budge

One of the defining characteristics of 2014 has been the return of geopolitical risk. For months there has been a constant stream of de-stabilising news from around the globe – from Russia’s annexation of Crimea to the advancement of Islamic State, pro-democracy demonstrations in Hong Kong and the spread of Ebola in West Africa and beyond.

-

Features

Special Report – Outlook 2015: War on Europe’s frontier

The economic and financial impact of Russia’s annexation of Crimea and Ukraine’s ongoing civil strife are mostly limited to the prime actors, writes Daniel Ben-Ami. But the Baltics are also exposed, and risks would be posed to the rest of Europe by an escalation of sanctions or a disruption of ...

-

Special Report

Special Report – Outlook 2015: Giving up freedom for security

Among the many casualties of the financial crisis, perhaps the least heralded but potentially of greatest long-term impact is the modern orthodoxy of central bank independence. Charlotte Moore describes how a new orthodoxy has been written

-

Features

Special Report – Outlook 2015: Monetary politics

Central bank independence is both a recent and a far from universal orthodoxy, notes William White. But the financial crisis has left the world with less of it and the likely further erosion could have significant long-term consequences.

-

Features

Special Report – Outlook 2015: Taxing times for investors

A crackdown on multinational tax avoidance could have significant impact on corporate strategy and portfolio investment theses, writes Anthony Harrington

-

Features

Focus Group: Don't run with elephants

Half of the investors polled for this month’s Focus Group allocate to hedge funds. One additional fund manages hedge fund strategies in-house.

-

Features

Diary of an Investor Praise indeed

My wife Jeanette is from France and it has been a great pleasure over the years to discover that country through her eyes and to get to know her family. This year, at the start of the autumn holidays, we drive down to Lyon with the children to stay with Jeanette’s sister Marie and her husband Jean-Baptiste.

-

Book Review

Book Review: Exploding the fairy tale

Essays in Positive Investment Management, Pascal Blanqué,

-

Interviews

On The Record: Veritas Pension Insurance Company, Finland, Niina Bergring CIO

The growth divergence between the US and Europe, and the different behaviours of the respective central banks, will simply mean two things: that the euro will be even weaker than it is, and that interest rates will be rigged for even longer in Europe than in the US.

-

Features

FeaturesInterview, John Corrigan, CEO, NTMA: Europe’s comeback kid

John Corrigan must have known he was not taking on the world’s easiest job when he became CEO of Ireland’s National Treasury Management Agency (NTMA) in November 2009. The National Asset Management Agency (NAMA) ‘bad bank’ had been set up to recapitalise the country’s ruined financial institutions, and plans were afoot to carve out a chunk of the National Pension Reserve Fund (NPRF) for the same purpose.

-

Features

Briefing, Investment: Breakevens breakout

Some key indicators of markets’ inflation expectations have broken sharply downwards during 2014. Caroline Saunders asks, should we – and central bankers – be worried?

-

Features

Global rating of pension systems, interview with David Knox, Melbourne Mercer Global Pensions index

Now in its sixth year, the Melbourne Mercer Global Pension index has become a yardstick for the world’s industry to assess the successes and failures of pensions policy.